Pipeline companies are viewed by Wall Street as engines of growth, especially as the oil boom in the U.S. continues.

While the industry will probably still use rail and barge for smaller markets, pipelines are often seen as the most reliable way to move large volumes of crude.

Analysts and the International Energy Agency estimate that the U.S. is on track to surpass Russia and Saudi Arabia as the world's largest producer of crude oil by 2035. But to achieve that target, the industry must overcome challenges like effectively accessing domestic oil supply and building out transportation networks for distribution.

To solve the transportation issues, a debate is raging over how to best transport the rising volume of domestic crude. Rail, barge and pipe are all viable options, but each comes with its own set of risks.

Read MoreIn moving US oil, 'flexible' rail bests pipelines

A series of rail accidents involving highly flammable Bakken crude prompted the U.S. Department of Transportation to propose new safety standards for shippers. And barge transport is being scrutinized after an accident in March spilled nearly 170,000 gallons of tar-like oil into the Houston Ship Channel.

Pipelines are often considered the safest option, although critics often worry about the potential for pipelines to leak.

"I think if you look at the safety record of crude oil pipelines versus alternatives, pipelines come out on top," said John Edwards, a senior analyst and director at Credit Suisse. "Release rates as of 2012 were roughly 25 barrels per billion barrel miles. So a very, very low rate of incidents taken over the hundreds of thousands of miles of pipelines that transport millions of barrels of oil per day."

Investing in safety

Edwards said companies are spending "billions and billions of dollars" on pipeline safety.

Enbridge Energy Partners is among them. Currently the largest importer of crude into the U.S. via pipeline, Enbridge brings in 17 percent of U.S. imports on any given day. The company runs 50,000 miles of pipeline and has moved 13 billion barrels through its system over the past decade.

Read MoreKeystone pipeline politics 'nuts': Ex-oil chief

"Enbridge had some incidents a few years ago, and as of the second quarter they have spent over a billion dollars [this year] to improve pipeline safety and integrity, particularly up in the North where there was a spill a few years back," Edwards said.

Bradley Shamla, senior vice president of U.S. operations at Enbridge, said the company is focused on safety as a cornerstone of its business. Their incident rate is 99.9993 percent, based on the 13 billion barrels the company has handled over the past 10 years.

"I could talk about our safety record in terms of [the 99.9993 percent incident rate] ... but we don't talk a lot about that because we're really focused on the very small percentage and no leak is acceptable. Our focus is really on eliminating all leaks with the goal of zero in our pipeline system," Shamla said.

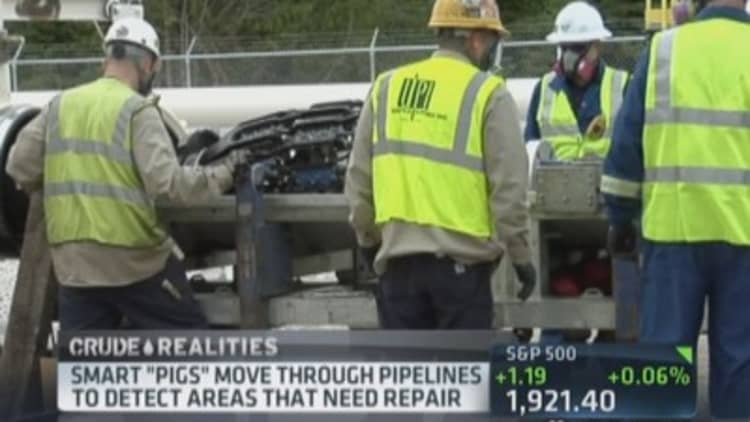

Putting the 'pigs' to work

Over the course of 2012 and 2013, Enbridge spent $4.4 billion to enhance its pipelines, with part of that going to improve the capability of "smart pigs," which the company uses to monitor its pipelines.

Read MoreCanadian oil rides south even without Keystone pipeline

"Smart tools are our primary source for being able to go in and really understand what's going on with the pipeline," Shamla said. "The smart tool has censors that read the pipe as they go. They're looking for things like metal loss on the pipe wall, any cracks, any defamation along the pipeline route, which would then allow us, and alert us, to come and do an investigation."

The "pigs" are monitored from a central control room in Alberta. From there, the company can dispatch first responders or shut down parts of the pipeline in case of an emergency.

Right now, the company is working on an integrity dig in Thief Falls, Minnesota. The site is one of nearly a thousand digs the company will make this year.

"We'll strip the top soil, excavate, expose the pipe and do the sand blast—then the site is ready for testing. Once that's complete, the pipe will be recoated and we'll start the process of putting it back in its pre-dig condition," Shamla said.

Eye on expansion

Credit Suisse's Edwards has an "outperform" rating on Enbridge shares with a price target of $39. The stock was trading Wednesday just above $32.

"Enbridge happens to be undertaking a very large expansion program right now to help improve reliability of crude transportation in the northern half of the U.S., that should help their cash flows grow over time ... and those are the things that factor into the valuation," Edwards said.

Enbridge also is a master limited partnership. Some investors like MLPs because many of them pay distributions to shareholders with an average industry dividend yield of almost 5 percent.

Some other stocks to watch in the sector include El Paso Partners, Kinder Morgan, Cheniere Energy Partners and Plains All American, analysts said.

"As far as other operators of crude oil pipelines, we also have an 'outperform' on Plains All American," Edwards said. "We look at Plains as one of the very best operators in North America and we think the management team is first rate across the some 50 to 60 publicly traded MLPs that we cover."

—By CNBC's Jackie DeAngelis