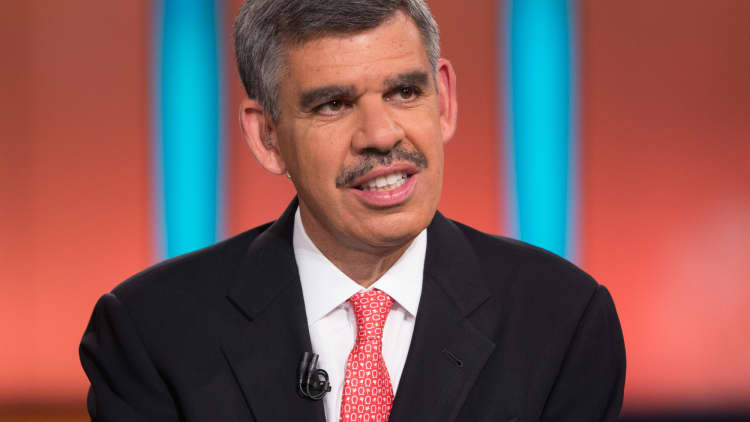

On pace for their largest weekly gains in six weeks, stocks are reflecting sentiment on easy monetary policies, Mohamed El-Erian, Allianz's chief economic advisor, said Thursday.

"It's impressive. And it's a bet on the Fed, and it's a bet on central banks in the rest of the world," he said.

On CNBC's "Halftime Report," El-Erian said that this week's data have been "shockingly poor, both out of the U.S. and out of Europe."

That suggests that central banks will be dovish for longer, he added. "What does that mean? The market needs to continue to bet on the fact that the central banks have been the market's best friend."

El-Erian had two qualifications for what happens next in equity markets.

"One is valuation matters, and at these levels of valuations for the bond market and for the equity market, they are telling you different things about the destination," he said. "And that's the second issue. It is not enough to bet on the journey. You need the destination to come through.

"So, I'm getting more and more nervous [about] this bet on bad-news-is-good-news. There's a limit the higher valuations go."

El-Erian noted that the effects of geopolitical trouble were beginning to appear "cumulative."

"Central banks cannot fight geopolitical headwinds for a long time," he said.

Also, there needs to be "a successful handoff from policy-induced growth to genuine growth," El-Erian added.

One area in which El-Erian saw potential trouble was liquidity risk.

"Liquidity is being underpriced today," he said. "When sentiment changes, the broker-dealers are not there to absorb paper on their balance sheets. They want to get out of the way just like anybody else gets out of the way, and investors should remember that. But right now, liquidity risk is not a major concern for most investors, unfortunately."

El-Erian noted a problem with betting that equities continue to climb on the back of monetary policy, calling it "a sucker's bet" in a Bloomberg View article.

"The bet on central banks assumes not just their commitment, which I totally agree with," he said on CNBC. "But ... it assumes their effectiveness, that somehow, central banks acting on their own will be able to deliver great economic outcomes."

Central banks, he added, have regularly fallen short of their own projections.

"And the reason is simple: They are using imperfect tools to try and achieve economic outcomes. So, unless the other policymaking entities get into the game, then we are going to play this repeated game. Meanwhile, the risk of financial instability goes up," he said.

"So, my concern is not whether the central banks are committed to being the markets' best friend—they are because they need the markets to attain the economic objective—my concern is that the tools may not be adequate."

—By CNBC's Bruno J. Navarro. Follow him on Twitter @Bruno_J_Navarro.