While a recent small business optimism index ticked up slightly, a look between the lines shows small business woes are emerging and creating a ripple effect on expansion plans and new hires. Rising health-care costs, the minimum wage debate and even more red tape are dampening entrepreneurs' outlook and ability to create jobs.

Few small businesses think now is the time to expand, and hiring was essentially flat for the 11th straight month, according to this week's release of the August small business optimism index from the National Federation of Independent Business. The report suggests even weaker job creation ahead.

William Dunkelberg, NFIB's chief economist, says it's simple. Business owners don't think things will be getting better anytime soon.

"The business environment is not favorable," Dunkelberg said. "Six months from now, more business owners think things will be worse off than those who think things will be better."

The flat small business data mirrored Friday's disappointing report from the Labor Department that showed 142,000 new jobs in August. That ended a six-month streak of 200,000-plus jobs created. The bottom line is key issues including rising health-care costs have created a big overhang on small to mid-sized employers, who are peering into the economic horizon and see few reasons for optimism.

Rising health-care costs

Just ask Gerry DeLong, owner of Hope Valley Farm, a dairy farm in Quarryville, Pennsylvania

DeLong said his health-care premiums have surged by 48 percent during the past year. While DeLong doesn't have to offer health insurance to his employees, he always has, and wants to continue to do so.

And as a farmer, DeLong said offering benefits is a key to attracting and retaining top employees to care for his 400 cows. "In farming, we have to do things differently to attract employees, and good employees, to the farm," DeLong said. "Offering health insurance is something I have done for as long as I can remember. I've always paid 100 percent of the premium, but I can only afford so much in the farming business."

Founded in 1978, Hope Valley Farm has six full-time workers who receive insurance costing about $1,000 per month, thanks to new increases under the Affordable Care Act and overall health-care inflation.

Higher health-care costs are weighing on the minds of many small business owners, who are just two months away from the open enrollment period for 2015 that kicks off in mid-November.

Read MoreObamacare's bill for small businesses? Big bucks, fewer jobs

President Barack Obama's signature legislation requires all business owners with at least 100 or more full-time workers to offer them government-approved insurance by the end of the open enrollment period on Feb. 15, 2015—or face a fine of $2,000 per worker, per year.

Those with 50 to 99 workers have some reprieve, until 2016, as the law's requirements were pushed back an additional year thanks to criticism from the small business community. NFIB economist Dunkelberg says his group's polling has shown health-care costs are the top concern for small companies during the past 25 years.

The minimum wage

Health care isn't the only issue worrying small business owners.

For Ken Jarosch, owner of family-owned Jarosch Bakery in Elk Grove Village, Illinois, a big concern is minimum wage. Democratic Gov. Pat Quinn wants to raise the minimum wage to $10 an hour from its current $8.25. Obama has led the push to hike the federal minimum wage from $7.25 an hour to $10.10 an hour.

Read More As Ikea raises minimum wage, pressure mounts for others

"That would increase our payroll by 5.5 percent, so I would have to raise my price by between 2 percent and 3 percent," Jarosch said. "My wait staff, sales clerks—they are high school kids. I can't see paying them more than $10 an hour right off the bat. I feel for those trying to raise families on $8.50 an hour, but we have to look at our interests."

Jarosch is also just below the full-time threshold for offering insurance to his workers, which is what is keeping him from creating new jobs.

Red tape

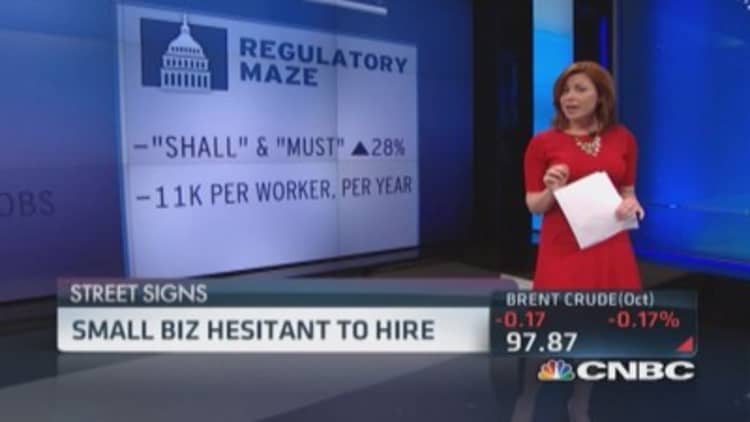

Regulations are another big concern for smaller employers, said Jared Meyer, policy analyst at the Manhattan Institute, a conservative think tank. In fact, since 1997, the use of the words "shall" and "must" in regulatory guidelines for businesses has increased by 27 percent, Meyer said.

"The regulatory maze, as far as the government saying you can't work or do this or that without an extensive permit or license means they can't expand," Meyer said. "That's where you are seeing hiring falling out. It's a side effect of the state."

The upshot for a smaller employer like DeLong's farm? Trying to run a more streamlined operation, and doing more with less.

"I'm not looking to expand," DeLong said. "We have regulations up the wazoo, and I want to be able to run the farm with the fewest amount of employees I can."

—By CNBC's Kate Rogers

Correction: An earlier version of this story, citing a Manhattan Institute analyst, incorrectly stated when regulations began to ramp up.