As 2014's trading days dwindle, some traders are turning toward small cap stocks in hopes of boosting their portfolio returns.

During Tuesday's sharp decline in U.S. equities and subsequent rebound, one notable outperformer was the Russell 2000 Index of small cap companies. While the Dow Industrials managed to recover 150 points from session lows and close lower by around a third of a percent, the Russell 2000 actually rose by 1.8 percent on the day. It was the best day for small caps since late October.

Of the 2,000 stocks in the index, 50 posted one-day gains of 10 percent or more, and one industry group in particular made up the bulk of the upside standouts—energy.

The top 50 performers in the Russell 2000 from trading on Tuesday are listed below:

Each stock was classified into an industry group, and it turns out that 32 were energy-related names, whether in oil and gas, oil services or coal. Biotechnology and pharmaceutical stocks made up the bulk of the remaining top performers. While each of these groups performed well during the index's rally Tuesday, they are two sectors with definitively different directions.

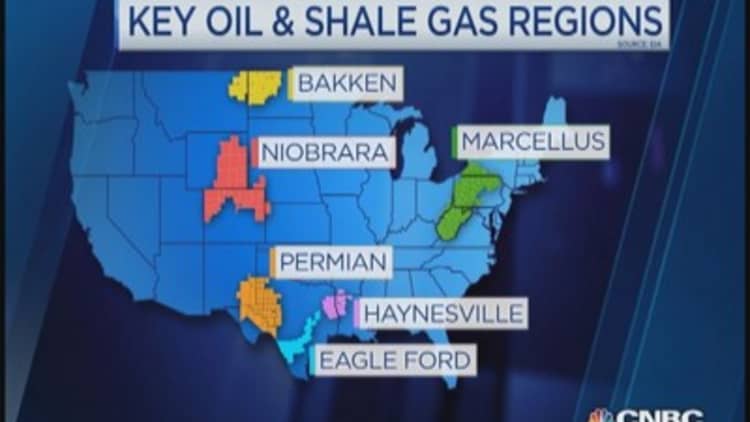

Energy stocks have been hit hard in 2014 due in large part to a decline in crude oil prices. As a result, the S&P 500 energy sector has lost 14 percent this year. That move lower has been filled with abnormally large swings in the stocks that are in that sector, and even more so with smaller capitalization companies that don't trade with as much ease and liquidity as larger names. The overall trend in the medium term has been to the downside for energy-related names, and that trend could continue.

"There's a long history of energy prices overshooting or undershooting any analyst's view of what fair value is, so we may continue to see some downward pressure for a while in the oil markets," said Atlantic Trust Chief Investment Officer David Donabedian. "I think the drop in oil prices is not yet a broad buying opportunity for energy stocks."

Read MoreEnergy sector could surprise in 2015: Lee

Despite the turmoil in energy markets, some Wall Street experts are telling their clients to avoid being fixated on falling oil prices. "We do believe that this is going to be temporary," said Mizuho Securities USA Chief Investment Strategist Carmine Grigoli. "You will have positive effects on the consumer, and production cutbacks are not expected to be enormous or significant that it will alter the economy."

Meanwhile, biotechnology, pharmaceutical and health-care companies overall have traded with more volatility than the overall market, but the trend has been higher prices. Health care is the best performing sector in the this year, with a gain of 26 percent. The Nasdaq Biotechnology Index has gained an even more impressive 37 percent in 2014. Biotechnology stocks are already viewed by many investors as volatile, and small cap stocks in the industry also trade with even more volatility.

Trading in small cap stocks has been a roller coaster ride, and after all that volatility, the Russell 2000 Index is still just positive by 1 percent for the year. Still, some market technicians, who study historical price patterns, say that small cap stocks are at an inflection point. Greywolf Execution Chief Technical Analyst Mark Newton thinks that if the Russell 2000 can manage to trade above its recent highs, it could lead to a period of outperformance that would accelerate.

"If the market were to stabilize today and [small caps] rally back up towards and over these highs, it would most likely drive the overall market higher into year-end, as everything would follow small caps," Newton said.

The recent action in small cap energy and biotechnology stocks presents an opportunity for some traders to attempt to use volatility to capture shorter term profits in the final three weeks of 2014. For many investors, the price action may be too much to stomach.

It's also important to note that even if there are elevated levels of volatility, the ability to garner outsized profits in trading small cap stocks is limited. Many of these stocks trade far less frequently than their larger cap cousins. There's a big difference between a stock that trades 200,000 shares a day, as opposed to one that trades 20 million shares daily.

Read MoreNo, cheap oil will not kill solar power

The bottom line when it comes to small cap energy and biotechnology stocks is that it's traders who are conducting much of the traffic in those markets. Investors may want to spend a good amount of time evaluating their risk tolerance before subjecting themselves to the possibility of outsized losses. Many of the big gainers yesterday are some of the big losers in today's trade.

—CNBC's Gina Francolla contributed to this report.