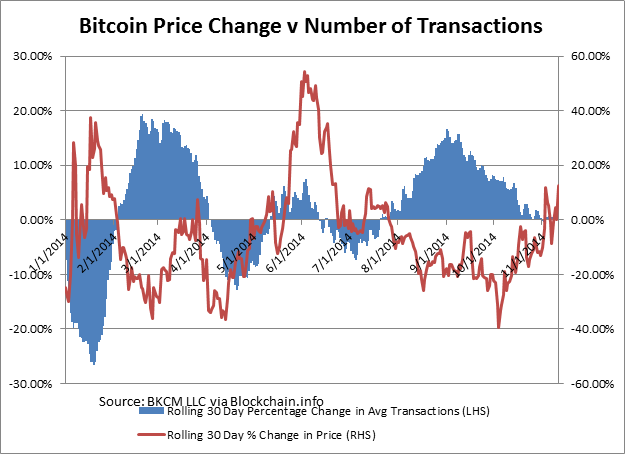

What's striking about this chart is that the price of bitcoin rises as the number of transactions fall — quite the opposite of the expected outcome. One reason for this inverse relationship could be that, as new merchants receive bitcoins, they immediately convert them to fiat currency. For example, DELL may have seen a large influx of purchases with bitcoin that were immediately converted into U.S. dollars to pay U.S. dollar expenses. Additionally, the volatility of bitcoin has been a deterrent to merchants holding onto bitcoin.

Read MoreWill 2015 be bitcoin's year?

This is why the announcement of a bitcoin futures-and-options broker is so exciting. Merchants will have more options to hedge bitcoin exposure which eventually could lead to fewer merchants immediately converting to fiat. In turn, fewer conversions will likely lead to a higher price and a virtuous cycle can commence. Derivatives can have a dampening effect on volatility which will encourage more businesses to accept and hold bitcoin. For speculators waiting for next leg up in the price of bitcoin merchants holding onto bitcoins received is a requirement for price appreciation. As a quick aside to those who may believe derivatives are the cause of volatility not the solution — I will simply say that leverage causes volatility, not derivatives.

Digital currencies are quickly becoming a new financial asset class for investors, traders and businesses. As early adopters profitably hand off to the next wave of institutional investors, the ecosystem will likely grow at an exponential pace. High-profile investors are a sure sign of an economy that is not just surviving; it's a sign that it is thriving. It is becoming increasingly likely that the 2014 reports of bitcoin's death have been greatly exaggerated.

Brian Kelly is founder and managing member of Brian Kelly Capital LLC, a global macro investment firm catering to high net worth individuals, family offices and institutions. He is also the creator of the BKCM Indexes, benchmarks for multi-asset money managers. He's also the author of the upcoming book, "The Bitcoin Big Bang: How Alternative Currencies Are About to Change the World." Kelly, a CNBC contributor, often appears on "Fast Money." Follow him on Twitter @BKBrianKelly.