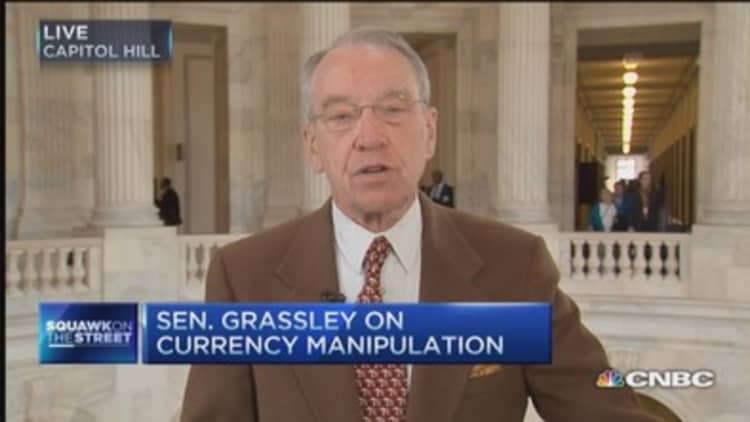

Both Democrats and Republicans have exercised too much caution in dealing with China on the issue of currency manipulation, Sen. Chuck Grassley, R-Iowa, said on Thursday.

"We've never wanted to charge them with manipulation and I think our caution has been to the disadvantage of the American consumer, to the disadvantage of our producers in this country," he told CNBC's "Squawk on the Street."

Chinese officials have leaned on the excuse that American concerns about currency manipulation amount to interference in China's domestic policy, said Grassley, who sits on the Senate's Committee on Finance and the Joint Committee on Taxation. He continued to say he would encourage the Chinese to open a dialogue with the United States on aspects of its own domestic affairs with which they disagree.

Read More Why Europe is breaking ranks with US on China bank

Measures taken by independent central banks that result in currency devaluation are valid, but monetary policy that aims to weaken a currency for the purpose of subsidizing exports ought to be an issue that is addressed in trade negotiations, Grassley said.

He said this tactic is used most often in China, and to some extent in Japan. A weaker currency makes a nation's goods more affordable in foreign markets.

China has long been accused of keeping the artificially low, and the People's Bank of China has recently launched stimulus measures, including reducing the amount of cash it requires banks to hold in reserve, which allows them to originate more loans.

The Bank of Japan is currently buying 80 trillion yen ($661 billion) per year in government bonds and other assets as part of a massive stimulus program. Prior to the program's launch, Japanese officials denied it was intended to weaken the country's currency, saying it was engineered to end two decades of deflation in the country.

Read More BOJ keeps massive monetary stimulus unchanged

Grassley said politicians had not interfered with the U.S. Federal Reserve, which ended a third bond-buying program in October after roughly six years of stimulus. The central bank has kept interest rates near zero, as well.

Asked whether a confrontation could spark a trade war, Grassley said the issue should be broached cautiously.

China has only allowed its currency to fall modestly over the last year, but the country's leaders could let the yuan weaken further to manage current economic conditions, Rebecca Patterson, chief investment officer at Bessemer Trust told CNBC last week.

A fall in the yuan of 5 to 10 percent against an already strong dollar would help China at the margins, but could politicize trade agreements and spark what Patterson called "devaluation contagion."

"If China devalues, then Japan goes, Korea goes, Taiwan goes, Singapore goes," she said in a "Squawk Box" interview. "All of that pushes up the dollar more. Then we have a bigger hit on the U.S. economy and a greater risk that it becomes really political and ugly."

Read More Beijing's next task: balancing debt and growth

The United States is negotiating the terms of a pair of major trade deals: the Trans-Pacific Partnership with countries in Asia, the Pacific and South America and the Transatlantic Trade and Investment Partnership with Europe.

Congress is considering whether to grant President Barack Obama the authority to "fast track" trade deals through an expired provision known as the Trade Promotion Authority. The TPA would presumably expedite negotiations with foreign partners by assuring them that the terms would not later be changed in Congress.