For eight years, Ben S. Bernanke, the former Federal Reserve chairman, was steward of the world's largest economy. Now he has signed on to advise one of Wall Street's biggest hedge funds.

Mr. Bernanke will become a senior adviser to the Citadel Investment Group, the $25 billion hedge fund founded by the billionaire Kenneth C. Griffin. He will offer his analysis of global economic and financial issues to Citadel's investment committees. He will also meet with Citadel's investors around the globe.

Read MoreHowto play the Fed-driven 'colossal dislocations'

It is the latest and most prominent move by a Washington insider through the revolving door into the financial industry. Investors are increasingly looking for guidance on how to navigate an uncertain economic environment in the aftermath of the financial crisis and are willing to pay top dollar to former officials like Mr. Bernanke.

Mr. Bernanke joins a long parade of colleagues and peers to Wall Street and investment firms. After stepping down, Mr. Bernanke's predecessor, Alan Greenspan, was recruited as a consultant for Deutsche Bank, the bond investment firm Pacific Investment Management Company and the hedge fund Paulson & Company.

More from The New York Times:

Obama's Effort to Slow Climate Change Heads to Court

Congressional Role in Iran Deal Shows Obama's Limits

PresidentVladimir Putin's Dangerous Moves

Last month, Jeremy C. Stein, a former Fed governor, agreed to join the $20 billion hedge fund BlueMountain Capital Management, where he will advise managers on issues like financial regulation, risk and the implications of the Fed's monetary policy. Mr. Stein resigned from the Fed last May to return to his tenured professorship at Harvard's department of economics.

In an interview, Mr. Bernanke said he was sensitive to the public's anxieties about the "revolving door" between Wall Street and Washington and chose to go to Citadel, in part, because it "is not regulated by the Federal Reserve and I won't be doing lobbying of any sort."

He added that he had been recruited by banks but declined their offers. "I wanted to avoid the appearance of a conflict of interest," he said. "I ruled out any firm that was regulated by the Federal Reserve."

After stepping down last year, Mr. Bernanke hit the speaking circuit, attending dinners and conferences for hedge fund managers like David A. Tepper of Appaloosa Management, private equity executives like Michael E. Novogratz of the Fortress Investment Group and other financial institutions. At the Fed, Mr. Bernanke made $200,000 a year, a sum he can now make in a single speaking engagement.

Read MoreFedhas 'tools' for smooth rates lift-off

While Mr. Bernanke declined to disclose his compensation, he said he would be paid an annual fee but would not own a stake in the firm or receive a bonus based on its performance. His arrangement with Citadel is not exclusive, so he could take on other consulting roles. Mr. Bernanke said that he could not determine exactly how much time he expected to devote to Citadel.

He added that he did not consider himself an investor; he plans to offer Citadel his perspective on monetary issues and other matters of public policy that Citadel will use as "inputs" into its investment decisions.

"I was looking for an opportunity to use my skills and knowledge," he said. "This is an interesting firm."

In a statement, Mr. Griffin said: "We are honored to welcome Dr. Bernanke to Citadel. He has extraordinary knowledge of the global economy and his insights on monetary policy and the capital markets will be extremely valuable to our team and to our investors."

Some of Wall Street's richest firms, including private equity and hedge funds, are hiring former central bankers, policy makers and regulators for top positions as they seek to gain an edge in an increasingly competitive and challenging market.

Last year, Timothy F. Geithner, the former Treasury secretary, joined the private equity firm Warburg Pincus. William M. Daley, a former White House chief of staff, joined the Swiss hedge fund Argentière Capital as a managing partner. In 2013, David H. Petraeus, the retired four-star general and former director of the Central Intelligence Agency, joined the private equity firm Kohlberg Kravis Roberts as chairman of its KKR Global Institute.

David H. McCormick, a former under secretary of the Treasury for international affairs in the Bush administration, is now co-president of Bridgewater Associates, the world's largest hedge fund, with $150 billion of assets under management.

"It is inevitable, if you are a bright, knowledgeable, battle-trained regulator or top-level player," said Erik Gordon, a professor at the Ross School of Business of the University of Michigan. "It takes a really unusual public servant to be able to decline the siren song of making a lot of money."

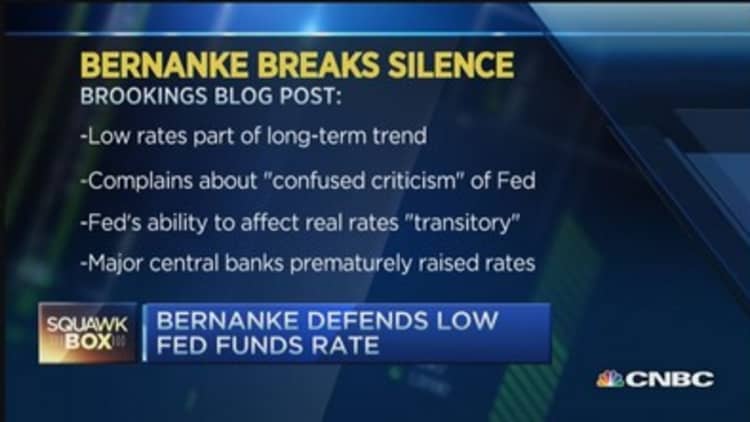

While Mr. Bernanke will remain a full-time fellow at the Brookings Institution, the new role represents his first somewhat regular job in the private sector since stepping down as Fed chairman in January 2014.

His role at Citadel was negotiated by Robert Barnett, the Washington superlawyer who also negotiated a deal for his book, "The Courage to Act," which Mr. Bernanke recently submitted to his editor and will be published in October.

Mr. Bernanke's insights are already much in demand.

At a gathering at the Bellagio Hotel in Las Vegas last May, several hedge fund managers said they had attended dinners with Mr. Bernanke in the first months after he stepped down from the Fed.

"At those dinners he gave credence to the idea that the Fed believed in lower potential G.D.P. and lower potential inflation," Mr. Novogratz told the audience of money managers. For many, that advice was well worth the cost of a seat at the time.

But one hedge fund manager missed out.

"He gave this stuff out," Mr. Tepper said, "but I didn't realize what he was saying at the time, so I didn't do a great trade."