Jim Cramer sees investors are fraught right now, because of the potential for a very difficult day of events on Friday. Worried investors hammered the market Thursday.

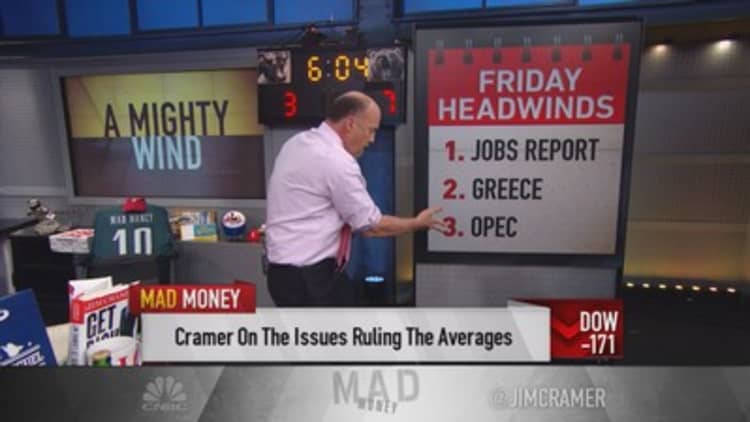

"Unfortunately, at least for the bulls, we have not one, not two, but three big bad events staring us right in the face," the "Mad Money" host said. (Tweet This)

The first of the big events on Friday morning is the Labor Department's employment report. Cramer has done extensive research on this, and warned that all non-farm payroll numbers are very important. All it takes is one number to determine the direction that the market is headed.

Right now the magic number that the bulls are terrified of is 220,000. If that good of an employment number is released, Cramer fears that the Fed may misinterpret the data and raise interest rates too soon.

"I don't think we're in steady mode at all. We're up and down. Every industry is up and down. The most important sector I follow, transportation, isn't even up, it's just down. There is real weakness in shipping, and that's a very bad sign for the economy," Cramer added.

Cramer can see the signs that the market is frantic about a rate hike. If you keep an eye on interest-rate-sensitive stocks, like the master limited partnerships, utilities and real estate investment trusts, you can see how they are floundering all over the place. These stocks have been hit hard, regardless of how well the companies are doing.

The next issue is Greece. Cramer said on Wednesday that he thinks the media has hyped the issue too much, but that doesn't mean it has gone away. There are too many people out there right now who still believe that it is the end of the world if Greece defaults. So, until there is some sort of a resolution, the world will be held hostage by this nation of 11 million people.

The third issue on Cramer's radar for Friday is the big OPEC meeting. In Cramer's opinion, it is pretty obvious that Saudi Arabia wants to maintain its market share and is willing to do so by any means necessary. So, they need to keep prices low in an attempt to slow U.S. production.

However, according to the statistics of RBN, capital expenditures in the oil patch have been cut but the U.S. is still expected to increase its oil and gas production versus last year. That is definitely not what OPEC wanted.

So what are the best options to resolve these three issues? We could see a resolution in Greece, or perhaps an in-line or soft employment number will slow the Fed down. In Cramer's perspective, we all need to just get through the OPEC meeting without anything major occurring so that oil can resume going down quietly and with minimal damage.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Amazing stock not done rallying

Cramer: Stop crying over Greece

Cramer: How to avoid single stock risk

----------------------------------------------------------

"I'd be remiss if I didn't acknowledge that these are real problems. There's typically a relief rally that comes after these big bad events. However, that might not occur until next Tuesday," Cramer said.

Cramer thinks the selloff that occurred on Thursday is totally rational and expected. So, either take advantage of it with your shopping list of stocks in hand, or be ready for the big headwinds on Friday, so you don't join the rest of the market and sell the good with the bad.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com