The U.K. government is planning to put its Royal Bank of Scotland shares on the block over the next few years – but may not be knocked over by a stampede of investors desperate for the stock.

There are still concerns that the bank has not reached the end of the shrinking and write-offs which have been a key feature of its post-credit crisis years – or proven that it will resume dividends.

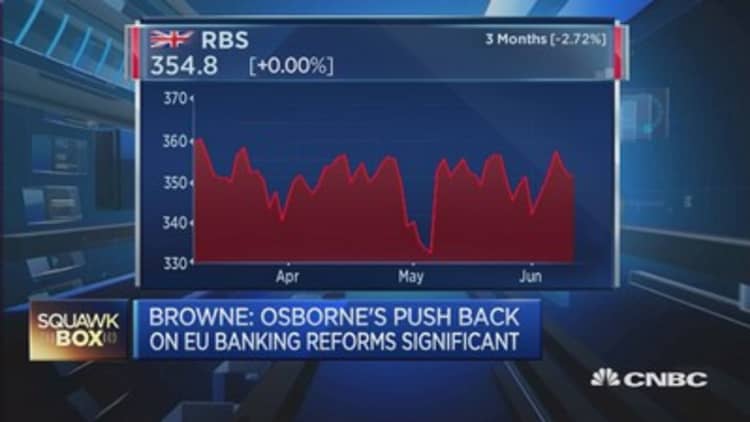

"The dividends are very much a 2017, 2018, 2019 story and that makes it tricky to sell off now," Michael Browne, a fund manager at Martin Currie who said he would not buy RBS shares today, told CNBC.

And the lack of dividends is not the only cause for concern.

More than 300 institutional investors, and more than 12,000 small retail investors, are suing RBS over its 2008 rights issue, an extremely complicated legal procedure which is not expected to go to trial until December 2016. The claimants, who include many of the top 20 private investors in the bank, argue that the earlier rights issue misled them over RBS's capital position and exposure to sub-prime mortgages, among other issues. RBS is disputing the claim.

"These guys don't join these actions unless they think they have a credible case," Ian Fraser, author of "Shredded: Inside RBS, The Bank That Broke Britain," told CNBC.

Given that big institutions like Legal & General are currently suing the bank over its last rights issue, it may be difficult to convince them to buy in new shares.

RBS is also facing lawsuits from the Federal Housing Finance Agency (FHFA) over the agencies ' loss on mortgage-backed securities sold to Fannie Mae and Freddie Mac.

Plus, RBS is in danger of being sued by nearly 300 small- and medium-sized U.K. business over allegations that its now-defunct Global Restructuring Group tried to make profits from their financial problems.

The specter of the Royal Mail privatization last year - which featured an apparently substantial underestimation of the share price, resulting in the government getting less for its stake than the subsequent market valuation - hangs over the RBS sale, too.

Yet the government has a number of important reasons for getting RBS off its hands, even at a loss.

"Capital in RBS is going to be much stronger when they get through the restructuring. When they get there, they'll have the ability to start paying dividends and doing all the things that normal banks do, and that should be a reason to buy the government shares," Sandy Chen, banks analyst at Cenkos, who has a buy rating on RBS, told CNBC.

Selling off RBS also means that it will be away from governmental control before the 2020 election.

And don't forget that RBS is a big play on the health of the U.K. economy, which may not be quite as ship-shape in a few years.

"Almost certainly, between now and 2020, we will have a recession – and it's hard to sell bank shares in a recession, so why not do that beforehand?" Browne pointed out.