Greece's central bank has warned that the country could experience an "uncontrollable crisis " and could ultimately leave the euro zone, if talks with lenders – which remain stuck in deadlock - fail.

The Bank of Greece said on Wednesday that a failure to reach an agreement with creditors would "mark the beginning of a painful course that would lead initially to a Greek default and ultimately to the country's exit from the euro area and – most likely – from the European Union."

"A manageable debt crisis, as the one that we are currently addressing with the help of our partners, would snowball into an uncontrollable crisis, with great risks for the banking system and financial stability. An exit from the euro would only compound the already adverse environment, as the ensuing acute exchange rate crisis would send inflation soaring," it said in a monetary policy report published Wednesday.

As such, an agreement with its European partners was of "the utmost importance," the bank added, in order to fend off risks to the economy and ensure a sustainable growth outlook for Greece.

The report comes as talks between Greece and its creditors reach crisis point. Indeed, whether the International Monetary fund (IMF) will even return to the negotiating table is questionable - particularly after Greek Prime Minister Alexis Tsipras aimed a bitter attack at the international lender on Tuesday.

Speaking to the Greek parliament, Tsipras said the IMF – one of Greece's senior creditors – had "criminal responsibility" for his country's financial crisis.

"The fixation on cuts...is most likely part of a political plan...to humiliate an entire people that has suffered in the past five years through no fault of its own," Tsipras said.

Read MoreGreece defiant; accused of 'breaking all the rules'

Greece owes the IMF 1.5 billion euros ($1.68 billion) on June 30, but has said it will not pay the debt unless it reaches a deal with creditors on reforms. Besides this repayment, Greece has a number of additional debts due to the IMF, European Central Bank (ECB) and bondholders later this summer and beyond.

Juncker angry

Tsipras words were greeted with incredulity in Europe, with one of the more sympathetic European officials - European Commission President Jean-Claude Juncker – saying Tsipras was distorting the truth about creditor demands.

"I am blaming the Greeks (for telling) things to the Greek public which are not consistent with what I've told the Greek prime minister," Juncker said at a news briefing Tuesday, Reuters reported.

Juncker said he didn't care "about the Greek government, I care about the people," adding that he has had "no contact with the Greek government since Sunday (when talks between Greece and creditors collapsed) because negotiations were going nowhere."

Read MoreEl-Erian: 55% chance of a Greek 'accident' happening

Building bridges

On Wednesday morning, it was reported that Greece had appointed an economics professor, Michalis Psalidopoulos, as its new representative to the IMF. The Greek government confirmed the appointment to CNBC and said he would take up the position on June 29.

Relations between Greece and the fund have gone from bad to worse after the IMF's negotiating team walked out of reform-for-aid talks last week, citing "major differences" between creditor demands and Greece's position on reforms.

While the former want to see pension cuts, labor market reforms and a sizeable primary budget surplus, Greece opposes a number of the austerity measures required of it.

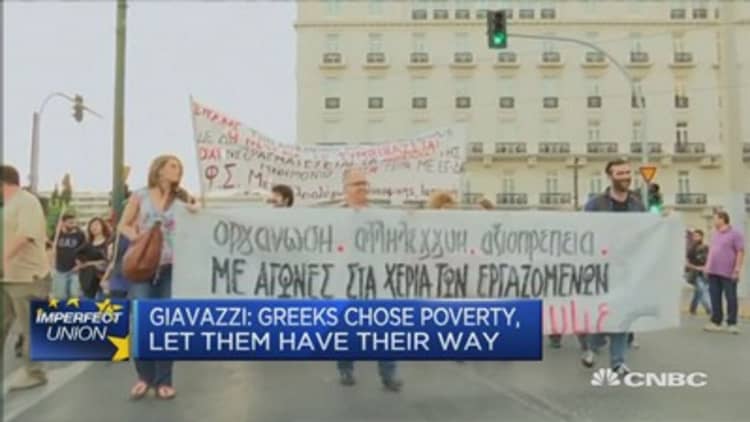

Francesco Giavazzi, professor of economics at the Bocconi University in Milan, told CNBC Wednesday that despite all of its financial aid, Greece had still not resolved its underlying structural problems.

"The Greeks have received from various places -- the ECB, the IMF, various European countries -- 400 billion euros worth of loans over the past few years. Now what they're asking is for those loans to be forgotten and for new loans to be given because they're unable to live within their means," he told CNBC Europe's "Squawk Box" Wednesday.

"There are reforms that would make new loans sustainable. But we're not going to put in new loans in the absence of reforms because that would mean throwing good money after bad."

- By CNBC's Holly Ellyatt, follow her on Twitter @HollyEllyatt. Follow us on Twitter: @CNBCWorld