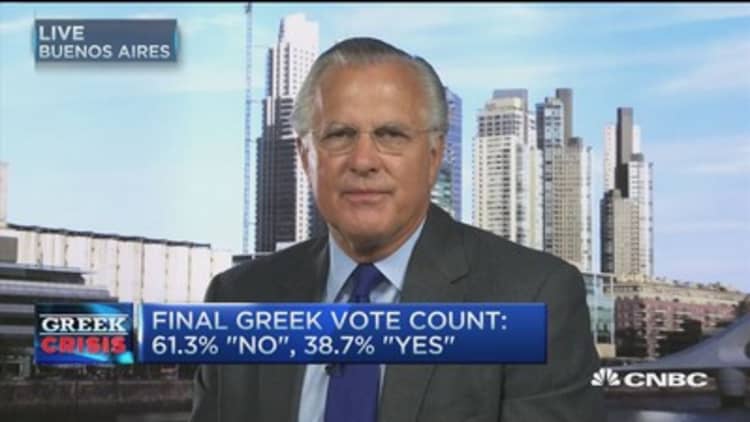

German Chancellor Angela Merkel will take pains to appear she is extending an olive branch to Greece, but she has little room to negotiate after Greeks voted "no" on economic austerity, former Dallas Federal Reserve President Richard Fisher said Monday.

"Ultimately, people report to their own people, and [Merkel] has to be supported by the German parliament and the German people," Fisher told CNBC's "Squawk Box." "There is a limit of tolerance, and she knows what that limit is."

"She is the modern Margaret Thatcher," he added. "You remember how people hated Margaret Thatcher. She is really the 'iron woman of Europe,' and I think she adopts a principled position."

Greeks voted against a bailout package put forward by Greece's creditors that would impose new austerity on the country. The vote was largely symbolic because the proposal was no longer on the table, but it moved Greece closer to default on a European Central Bank loan and signaled a potential first step toward its exit from the 19-nation euro zone.

Read More 'Toxic' Varoufakis is out: Time for a deal?

Greece has a 3.5 billion euro payment due July 20 on a bond held by the European Central Bank. It entered arrears last week after failing to pay 1.6 billion euros on a bond held by the International Monetary Fund.

There is enormous weight on Germany to participate in "European theater" and appear to be eurocentric rather than focused solely on its domestic interests, Fisher said. "This is still the legacy of the war and of German economic dominance, so of course Angela Merkel and her government ... have to keep saying they're going to keep working at it, working at it, working at it."

However, based on how firm Germany has been on the terms of the offer it has made to Greece, Fisher said there is little negotiating room in reality. He added that he assumes the ECB, led by Germany, probably has a contingency plan in place to smooth out market effects.

Greek banks remained closed and capital controls were still in place ahead of a ECB meeting Monday on emergency lending to the country and a summit of European Union leaders set for Tuesday. The ECB froze increases to emergency lending last week after Greek Prime Minister Alexis Tsipras called the national referendum.

The country's bank are set to run out of money this week, so the ECB may set up some sort of bridge financing, but it must do so in a way that eases pain while maintaining the creditors' negotiating position, Fisher said.

Read More This is Greece's real risk to asset prices: Analyst

Rules and discipline are very much part of the German mentality, and the Greeks violated rules and discipline, Fisher said. If Greece leaves the euro zone, the euro currency should increase in value, he said.

"You take one of the weights on the economic progress of the system, even though it's a tiny weight, out of the system. Once you get through the disruption and the liquidity squeeze and whatever short-term market disruptions there may be, economically speaking, it should be a stronger currency by virtue of taking a weak member out."