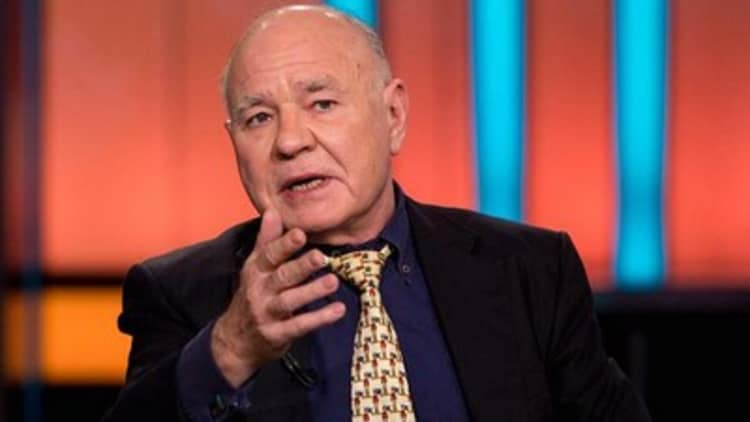

The U.S. stock market could "easily" drop 20 percent to 40 percent, closely followed contrarian Marc Faber said Wednesday—citing a host of factors including the growing list of companies trading below their 200-day moving average.

In recent days, "there were [also] more declining than advancing stocks, and the list of 12-month new lows was very high on Friday," the publisher of The Gloom, Boom & Doom Report told CNBC's "Squawk Box."

"It shows you a lot of stocks are already declining."

Faber said U.S. stocks are on the "high side" right now, despite Tuesday's decline, and expectations are quite high, which can lead to big disappointments such as Apple after issuing a softer revenue outlook. The company's earnings just beat estimates, turning off investors.

"In the U.S., the market could easily drop 20 percent to 40 percent," he said. The downside risk is lower in already depressed markets outside the U.S., he added.

Faber has been predicting the meltdown of U.S. stocks for years, only to see the market climb higher.

Faber, who lives in Asia, said he sees "no growth" coming from the economies there, with some countries in recession. As a result, Faber does not see much strength coming from the rest of the world. He called the expansion in Europe "anemic."

The situation in Greece, where the nation is receiving bailouts to pay back borrowed money, is "basically Ponzi finance" that can't last, Faber said.

He's also concerned about the recent weakness in commodity prices.

"Supplies haven't gone up that much, and do not reflect the price weakness," he said. "The prices weakness is because of weak demand."

"May be this the signal that there are strong deflationary forces despite all the money printing by central banks," he added.