Some just want to annihilate the dragon. Some want to crush the candy so bad they'll shell out hard-earned cash to advance to the next level. Some will even spend thousands of real dollars to visit a virtual casino with no chance of a real, actual jackpot at the end.

This is the growing world of in-app purchases, or "micro transactions," a multibillion dollar industry based on "freemium," a category of smartphone apps that are free to download but users can pay real money to either continue using past a certain point or to advance in difficult or hard-to-beat levels.

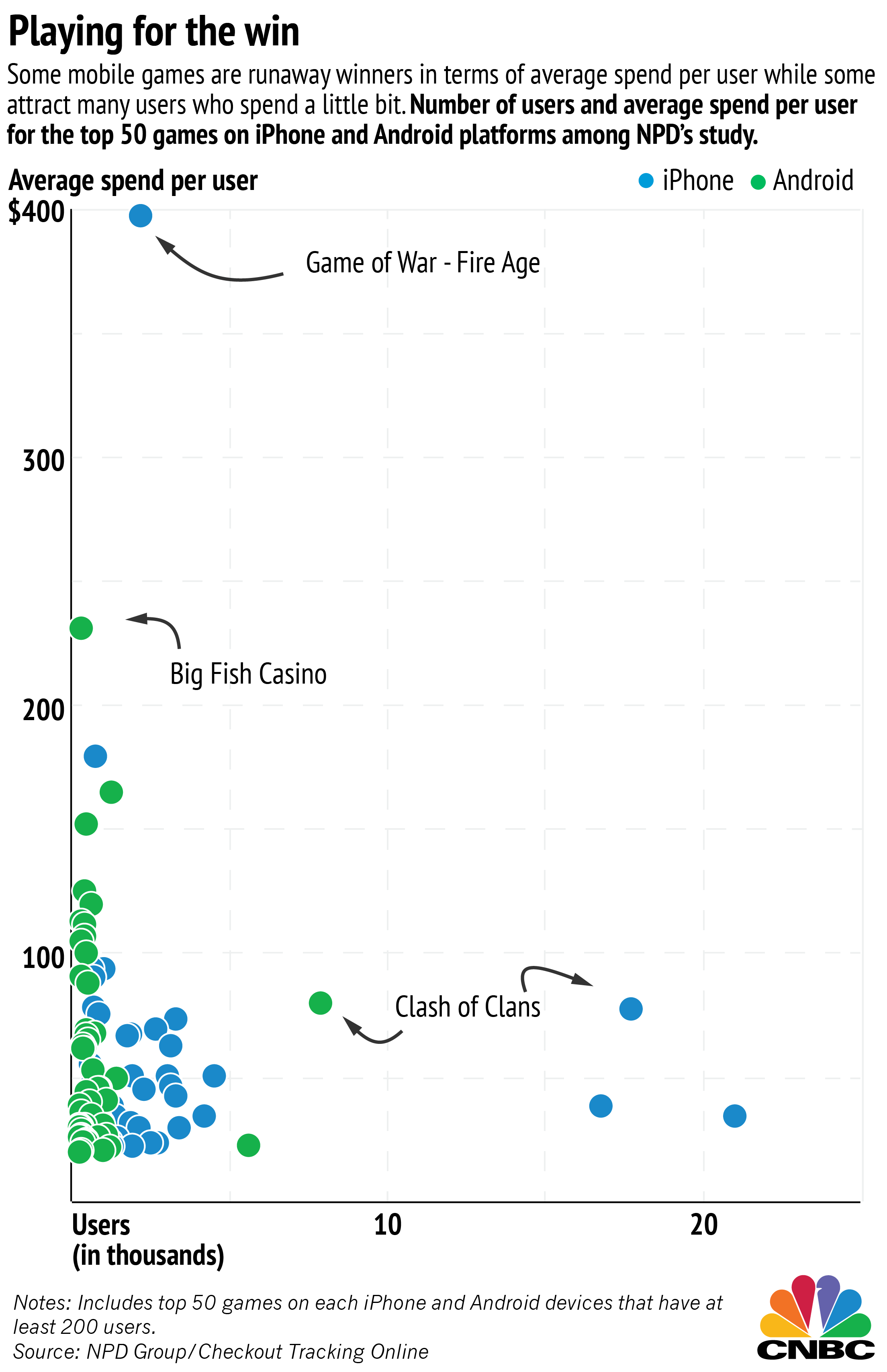

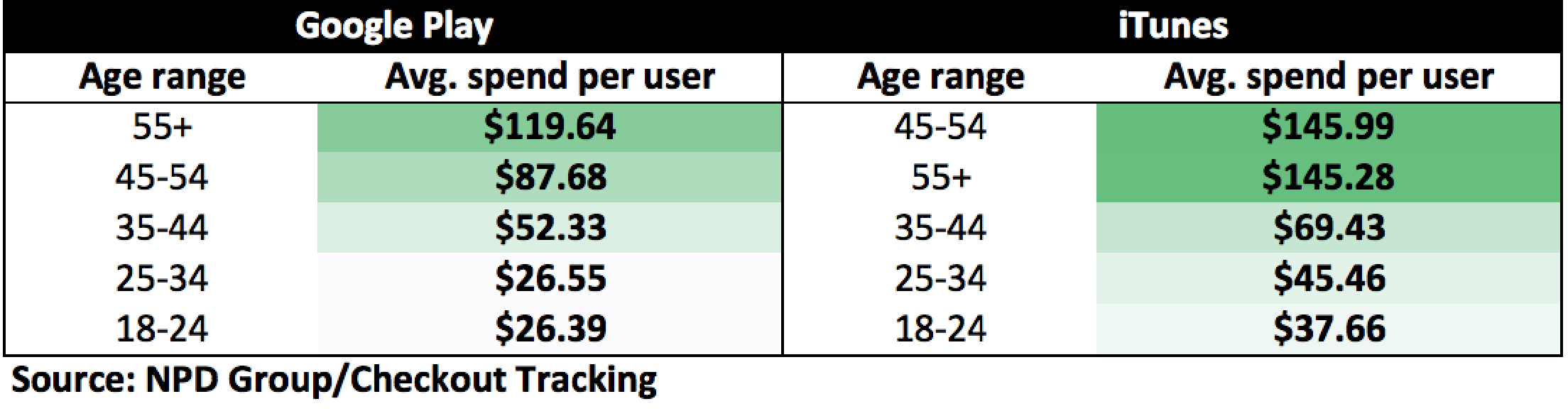

Data suggest that iPhone users tend to spend more than Android users, and in general, the world of in-app purchases is no different. Those who choose Apple spend more on average in nearly all games that are supported on both platforms, according to data provided to CNBC by NPD Group's Checkout Tracking. Checkout Tracking studied the behavior of its users in the six-month period between December 2014 and May 2015.