For the past five years, I have been ranting and raving that the banking system in the United States has been nationalized and this allows a small coterie of individuals to direct fund flows in the United States economy which is directly contrary to free market capitalism. My fundamental problem with this is that no one seems to care. Both liberals and conservatives have apparently joined in a belief that free capital flows in the United States are not a very good idea — that it's better for the government to determine these flows.

Recently, Charles Koch, a major contributor to the Republican Party, was quoted by the Washington Post as saying this about the banking system and the Federal Reserve at a seminar for Republican donors in California:

"Now the chickens are coming home to roost. The Fed has taken control of these banks. The Fed now decides what businesses they can be in and how they can run those businesses, and they've implanted, whatever you want to call them – regulators, auditors, controllers – to make sure the banks follow these rules. And when they deviate at all, guess what? They get multibillion-dollar fines."

From both sides

It's coming from both sides of the aisle: Democrats and Republicans are lining up together to tighten control on the banking industry.

Read MoreBove: Time to 'aggressively' buy big banks

John McCain (R-Ariz.) has joined with Elizabeth Warren (D-Mass.) sponsoring a bill that would bring back Glass Steagall restraints on the banking industry and thereby fund flows in the United States. David Vitter (R-La.) teamed up with Sherrod Brown (D-Ohio) to introduce a bill in the Senate to demand a sizable increase in capital at big banks. One clear result of this bill would be to restrict fund flows to the economy.

Last year, Senator Mike Crapo (R.-Idaho) teamed up with former Senator Tim Johnson (D-SD) to curtail the fund flows into the mortgage market by shutting down the government-sponsored enterprises in favor of a much smaller secondary market. Senator Shelby (R-Ala.) has picked up remnants of the Corker (R-Tenn.)-Warner (D-Va.) bill in his new banking legislation. Senator Shelby wants to restrict mortgage flows through the GSEs and big banks in favor of a variety of smaller institutions.

Last month, in an opening statement on the Dodd-Frank hearings, Banking Committee Chair Jed Hensarling (R-Texas) stated his reservations concerning that piece of legislation. However, he also decried the fact that big banks got bigger since the passage of the act and this was a trend that was worrisome.

Read MoreBove: Bank of America stock to double—here's why

The problem here is not his comments on the size of the banks. It's that, in seeking a reduction in the size of these institutions, Mr. Hensarling is also seeking a shift in money flows in the United States since small banks are unable to service the same clients as the big banks do.

The money is flowing to the government

The government has taken control of the banking industry and is directing its fund flows to where a small group of people in the Federal Reserve believe to be appropriate. Those people being Fed governors, Chair Janet Yellen and Daniel Tarullo, who is in charge of bank regulation. And they seem to think that the money should go to the Federal Reserve rather than the economy.

From the end of 2007 to the end of 2014, the money supply of the United States, M-2, grew by $4.2 trillion. Bank deposits captured $3.5 trillion of this amount, or 83 percent. Stated differently, 5 of every 6 dollars created in the U.S. money supply from the end of 2007 to 2014 went into bank deposits.

The Fed was not going to let the banks determine what to do with this money. The Federal Reserve Board wrote a series of regulations that required the banks to put this money into the Federal Reserve itself. The total deposited into the Fed was $2.6 trillion. So, putting the growth of the money supply with the increase in bank deposits at the Federal Reserve, we see that 62 percent of the new money created since the end of 2007 to 2014 went to the Federal Reserve. The Fed used the bulk of this money to buy U.S. government guaranteed debt. Three of every five new dollars did not go into stimulating economic growth, it went to the Federal Reserve at the direction of the Federal Reserve.

During last week's GOP debate, not one of the Fox moderators asked a question about the banking system and money flows through the system. They were far more interested in baiting Donald Trump.

Read MoreOp-ed: What Trump and Bush did wrong in the debate

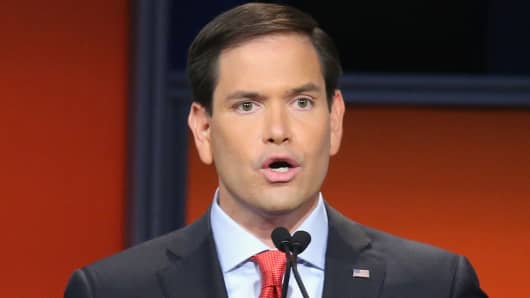

Marco Rubio (R-Fla.) was the only one who addressed the banking system. He loudly and clearly said we must eliminate the Dodd-Frank Act. This is the act that gave the government total control over the banking system and money flows in the economy.

Thank you, Senator Rubio, for trying to introduce a real financial issue into the Republican debate.

Commentary by Richard X. Bove, an equity research analyst at Rafferty Capital Markets and the author of "Guardians of Prosperity: Why America Needs Big Banks" (2013).