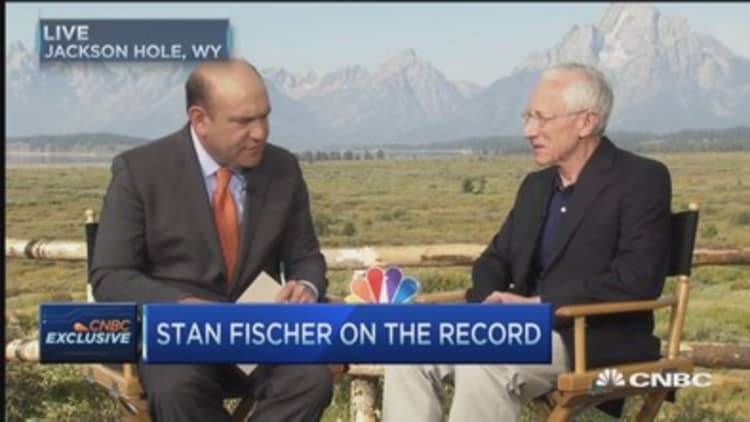

It's too early to determine if recent market turmoil has made a September rate hike more or less compelling, Federal Reserve Vice Chairman Stanley Fischer told CNBC on Friday.

Investors are watching the Fed closely for signs of an impending tightening. As international and U.S. markets swung wildly this week, some questioned whether the conditions were anywhere near appropriate.

"I think it's early to tell: The change in the circumstances which began with the Chinese devaluation is relatively new and we're still watching how it unfolds, so I wouldn't want to go ahead and decide right now what the case is—more compelling, less compelling, et cetera," he said.

He added that "there was a pretty strong case" for a September hike, although that had not yet become a conclusion.

"We've got a little over two weeks before we make the decision," he said. "And we've got time to wait and see the incoming data, and see what is going on now in the economy."

One big sign comes next Friday, when the August jobs report is released.

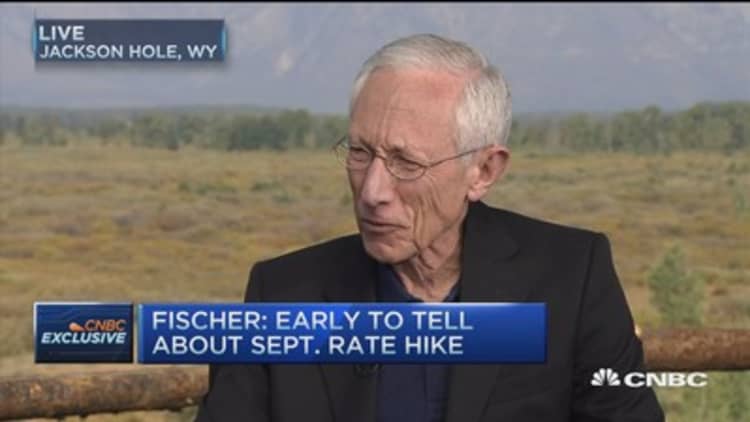

Fischer conceded that the recent market volatility will affect the Fed's decision making.

"If you don't understand the market volatility—and I'm sure we don't fully understand it now, there are many many analyses of what's going on—yes it does affect the timing of a decision you might want to make," he said.

Short-end bond yields turned slightly higher on Fischer's comments.

Former Dallas Fed President Richard Fisher said the vice chairman "did the right thing by being perfectly neutral."

On the international front, Stanley Fischer said the movements in the Chinese yuan will have "some small impact," but he cautioned that "we still got to wait and watch and see how this turns out."

He also said the direct effect of a Chinese slowdown on the U.S. economy will be "relatively small." He added, however, that the concern is whether the full weight of China's impact on its region could then affect the U.S.

Fischer said his level of confidence is "pretty high" that U.S. inflation will return to the Fed's target, as factors like oil's low price are transitory.

Still, he added that he has not seen "much evidence" of increasing risks to staying at near-zero rates for longer, but he also said he didn't want to wait too long.

"When the case is overwhelming, if you wait that long, you'll be waiting too long," he said. "There's always uncertainty."

Fischer emphasized that the Fed's tightening will be slow and not drastic.

"We do not intend doing a rapid rate of increase," he said.

Earlier this week, New York Fed President William Dudley made headlines when he played down the chances of a September rate increase.

"From my perspective, at this moment, the decision to begin the normalization process at the September FOMC meeting seems less compelling to me than it was a few weeks ago," Dudley said Wednesday.

Some have pointed to that comment as part of the reasons U.S. stocks have rallied during the second half of the week.

On Friday, Richard Fisher, the former Fed official, said it appears a September rate hike is "still on the table."

"If the data aren't compelling, it looks like they'll be moving either to October, possibly, or to December," Fisher said. "I think he and others have signaled very clearly that they will be moving this year and I believe that market has begun to discount that."