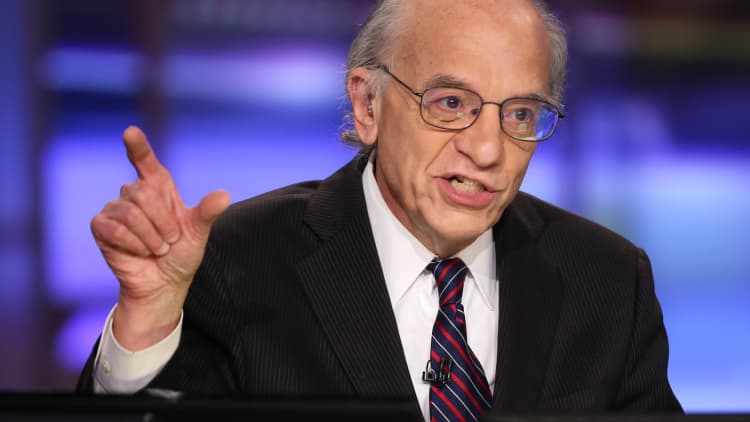

While all eyes are usually on the payroll increase in the monthly jobs report, noted Wharton School finance professor Jeremy Siegel said the unemployment rate is what investors should watch for in Friday's report.

That's because it's "very critical" to the Federal Reserve's decision on whether to raise interest rates, he said Thursday in an interview with CNBC's "Closing Bell."

Most Fed officials believe an unemployment rate in the 5.0 to 5.2 range is consistent with full employment.

"If we see 5.1 tomorrow morning I think the odds of a Fed increase in two weeks goes way up," said Siegel.

Mark Zandi, chief economist of Moody's Analytics, told CNBC on Wednesday after the ADP jobs report was released that the unemployment number will almost certainly be going to 5.2 and may go to 5.1. Siegel believes Zandi is one of the best forecasters.

In addition to the unemployment rate, there has been some stability in the dollar and oil is up from its lows, which are also positive signs for the Fed, Siegel pointed out.

While he's pinning the odds at more than 50-50 that there will be a rate hike in September, he said the increases will be gradual. And once that rate hike is out of the way, there will be a much-better climate in equities, he said.

"That uncertainty is weighing terribly on the market and if it's behind us with the concept that they are not going to be aggressively raising rates, with stability of oil and the dollar, I think the fourth quarter can still be a winner for stock investors."

A few weeks ago, Siegel predicted that there might be a correction coming that could be "very rough." Since then, the major averages have dipped in and out of correction territory.