Asia and luxury once slotted together as well as Cinderella and the glass slipper, but as China's economic situation deteriorated, the slipper become somewhat ill-fitting.

Take Italian fashion house, Prada. The brand has published a slew of disappointing earnings reports this year, naming Asia-Pacific as the region weighing down growth. Other luxury brands have managed to float above water by relying on demand from the U.S. and Europe.

Designers and fashion chief executives were determinedly optimistic at this month's London Fashion Week, in a city well-frequented by wealthy Chinese looking to buy European luxury brands.

"China – specifically Hong Kong, Macau – everybody knows there's been a struggle there. However, the important thing is to keep making sure you have a point of view, make sure you keep your authenticity and give the best customer service in those countries," Christopher Bailey, chief executive of Burberry told CNBC.

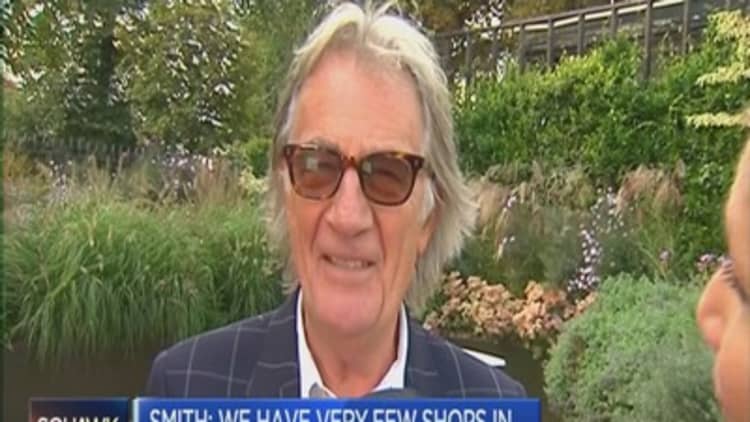

Fellow U.K. fashion brand, Paul Smith, has only a handful of shops in China but is widespread in Japan. Smith told CNBC that he was cautious on Asia, but insisted the brand was in a "strong position compared to others."

"Some countries are very steady, some are slightly up and sadly some are down; but that's the same with all the big companies, not just us," Smith told CNBC.

So instead of pulling back and capitalizing on other markets, luxury fashion brands are staying put. How come?

"I think they (luxury brands) genuinely still see an opportunity in China," Winston Chesterfield, research director at Wealth-X, told CNBC, adding that a devaluation in the yuan and market volatility would not deter purchases.

Chesterfield said that Asian consumers preferred buying "Made in Europe" products that resonated when travelling, as purchasing in Europe adds an "authentic experience."

"It means that they're buying a genuine product. They feel they can tell the difference between a fake brand set up in China and the genuine ones that come from Europe," he said.

In general, Chinese consumers are still buying luxury brands, just not at the same rate, said Fflur Roberts, head of luxury goods at Euromonitor International.

"They have had a long history of buying luxury abroad, where it is cheaper, but owing to the unfavorable exchange rates they have been buying much less. Prices may also go up in China in the short-to-medium term, meaning they are even more inaccessible," said Roberts.

High street fashion brands are also watching China carefully, although Philip Green, chairman of Topshop owner-Arcadia Group, told CNBC that his company had low exposure to Asia and was seeing growth in other markets, including online.

Roberts echoed Green, suggesting retailers universally might focus outside of Asia for pockets of growth, with profits looking better in Western Europe and North America.

To remain popular in the likes of China, it may be a case of tailoring the brand to the domestic market, Chesterfield suggested.

"Luxury brands could do more diffusion lines in China, more Chinese ranges, and they could potentially sell more products in the country that you couldn't find elsewhere," he said.

Chesterfield added that products that were ubiquitous put people off brands, so they should focus on exclusivity.

"What brands should start thinking about is kick-starting more domestic demand, as there's not much luxury brands can do about structural changes like tax," he said.

—By CNBC's Alexandra Gibbs, follow her on Twitter @AlexGibbsy.