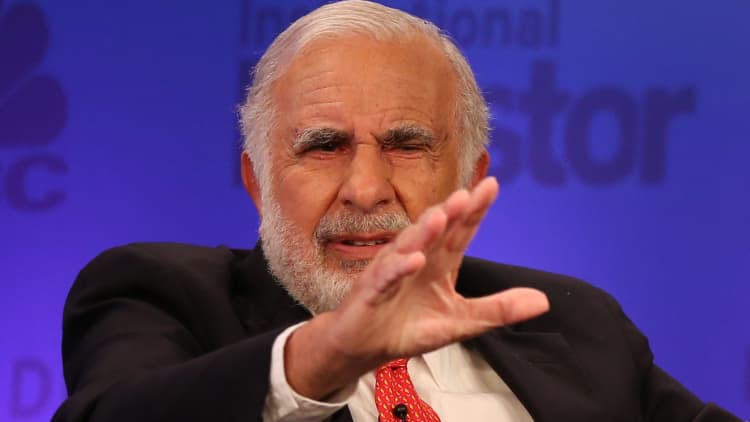

Billionaire investor Carl Icahn thinks stocks could go down "a lot more" as the market comes to grips with bubbles exacerbated by the Fed's zero interest rate policy.

Icahn, in a new video titled "Danger Ahead" that he produced himself, warns that major market upsets of the past could be seen again, perhaps even worse, as a result of interest rates that have been kept too low for too long.

"It's like giving somebody medicine and this medicine is being given and given and given and we don't know what's going to happen – you don't know how bad the end of this is going to be," Icahn said in the 15-minute video. "We do know when we did it a few years ago it caused a catastrophe, it caused '08, so where do you draw the line here?"

Read MoreIcahn warns potential catastrophe looms

Low rates are one of five major worries Icahn outlines in the video, along with tax loopholes, financial engineering of earnings, balance sheet-weakening stock buybacks, and strains on the high-yield bond market.

But while Icahn argues the Fed should have hiked interest rates month ago, he admits that doing so now is harder, given China's weakness and concerns about other emerging markets.

Icahn told CNBC the Fed "may have backed itself into a corner."

It's just one reason why he thinks stocks, which have been correcting for several weeks now, could go down "a lot more," admitting he's more hedged than he's been in years.

Also catching Icahn's ire — corporate earnings which he calls "suspect," driven by low interest rates more than anything else.

"Instead of taking the money that they can borrow and really invest it in machinery, in their workers to make them more productive, what they do with the money is almost perverse. They just go in and buy another company to show analysts on Wall Street that earnings are going up, so their stock will go up and it's financial engineering at its height."

One stock Icahn does not appear to be worried about is Apple – his largest position — telling CNBC he's sticking with it, and that the size of his position is "the same it's been."

Read More Icahn raises stake in Cheniere Energy to 11.43%

But it's some of Icahn's other, newer positions that have raised eyebrows with investors. The billionaire has built large stakes in Freeport-McMoRan and Cheniere Energy, which have suffered in the commodities crash. Icahn told CNBC he bought shares of Freeport because he thinks copper prices "will recover in a couple a years" and called Cheniere a "free stock option" if energy goes up.

Icahn also takes issue with a dysfunctional Congress – and says tax reform is needed on the issue of inversions and the repatriation of foreign profits.

He also has some thoughts on who could bridge the divide in Washington — a certain Republican candidate for President, who's currently leading in the polls.

"You need a president who could move Congress and I think Donald Trump could do it, says Icahn. "I disagree with him on certain issues and certainly will talk to him more, before getting completely behind him, but this is what this country needs – somebody to wake it up."

Trump has mentioned Icahn as a possible Treasury Secretary, a notion the investor laughingly dismissed when asked by CNBC.