Pharmacists. High-security gated vaults. Sub-zero refrigerators the size of apartments. Forklifts zipping between rows of floor-to-ceiling boxes, standing several stories high.

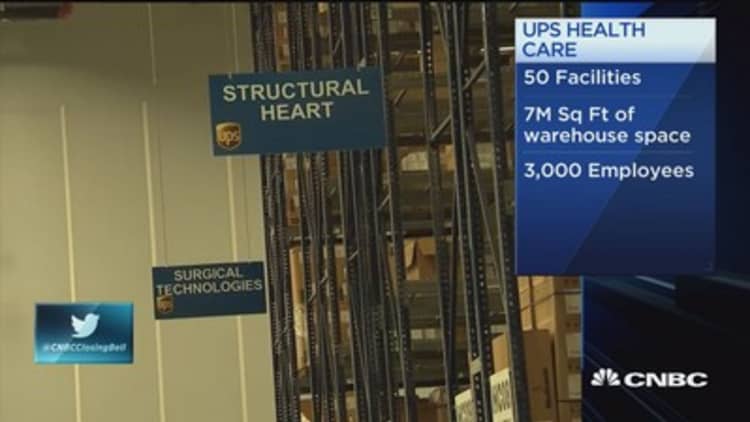

This is what the inside of UPS' main health-care hub in Louisville, Kentucky, looks like: 1.4 million square feet of temperature-controlled space occupying 40 acres down the street from the shipping giant's WorldPort facility. It's one of 50 specially designed warehouses catering to shipments of medical drugs, surgical devices, even human material such as blood and stool samples.

It's part of a big push by UPS into a business that's booming: health-care logistics. As the baby boomer population ages, UPS is betting that the sector will become an even larger part of its future.

"The number of people over the age over 50 is expected to double over the next couple of years, creating a larger demand for health care," said John Menna, vice president of Healthcare Logistics for UPS.

"It's moving at a faster rate than GDP," Satish Jindel, president of transportation advisory SJ Consulting group, said of the health-care logistics industry.

UPS, best known for delivery of e-commerce packages, has been building a specialized network dedicated to the $7 trillion health-care sector. The shipping giant on Wednesday announced the opening of its first medical device facility, located in Swedesboro, New Jersey.

Time is of the essence here. They have a three-day commitment on the outbound leg and overnight commitments on the inbound leg on the shipping. That's really critical for us.Kevin ConroyCEO, Exact Sciences

The facility is dedicated to the shipping and logistics of high-end medical devices, such as those from Alphatec Spine, which specializes in spinal products. One 300-piece kit is delivered to hospitals on a loaner basis, and then sanitized and returned — sans certain parts implanted patients — to Swedesboro to be inventoried and replenished over the course of a day. The kits then ship back out to hospitals for more surgeries as soon as 36 hours later, and the process repeats. UPS says 60 percent of returned kits are sent back out within 24 hours.

"The medical profession is focused on reducing cost of services. That is where UPS, FedEx and DHL are involved. It creates greater opportunity for them," said Jindel. In the case of Alphatec, utilizing UPS's network means kits can be reused, thereby reducing the number that need to be manufactured.

It's not just surgical equipment being transported — it's also highly sensitive things such as drugs that often require special handling.

"The products that require temperature-controlled movement and storage that are time sensitive — that's what makes us attractive," said UPS's Menna.

For medical device company Exact Sciences, UPS acts as a logistics hub for its Cologuard at-home colon cancer screening tests. The kits are packed at UPS' Louisville hub and shipped to patients' homes, to then be picked up and delivered to laboratories for testing.

"Time is of the essence here. They have a three-day commitment on the outbound leg and overnight commitments on the inbound leg on the shipping. That's really critical for us," said Kevin Conroy, chief executive of Exact Sciences. "It's really changing the whole paradigm about colon cancer screening, and UPS is right in the middle of it."

UPS estimates that health-care logistics is a $70 billion global market, growing at an annualized rate of 4 percent. The company doesn't disclose the financial performance of the division, but said health care is one of its fastest-growing streams of revenue.

"A lot of UPS' business is cyclical. Health care is more stable and provides decent returns to the organization throughout the year," said Menna.

UPS isn't the only logistics player working for health-care companies. FedEx and DHL have made significant investments in their health-care supply chains as well.

FedEx, which this year acquired logistics services firm Genco, has more than 4 million square feet of space dedicated to health care. It has developed technology called SenseAware that monitors shipments and tracks everything from temperature and light exposure to barometric pressure.

DHL's supply chain generates $3.7 billion from health care and life sciences, according to SJ Consulting Group. It has a similar shipment monitoring system called SmartSensor and works closely with drug-makers including Pfizer and Johnson & Johnson.

Analysts say health-care logistics is an attractive space with a lot of opportunity, particularly Stateside.

"Obamacare has added millions more people to insurance programs and as a result, they will be consuming more pharma products," said Jindel.