If you like cheap beer, then this is the merger for you.

Global megabrewer Anheuser-Busch InBev announced Tuesday that it had reached a tentative agreement to purchase its rival SABMiller for $104 billion. If it's finalized, it would be the fourth largest takeover deal in history and the biggest this year. That means that rival brews like Budweiser and Miller Lite would be sold by the same company.

AB InBev brews brands like Stella Artois, Beck's and Leffe. SABMiller makes Peroni, Leinenkugel's and Coors, through an agreement with Molson Coors Brewing Co.

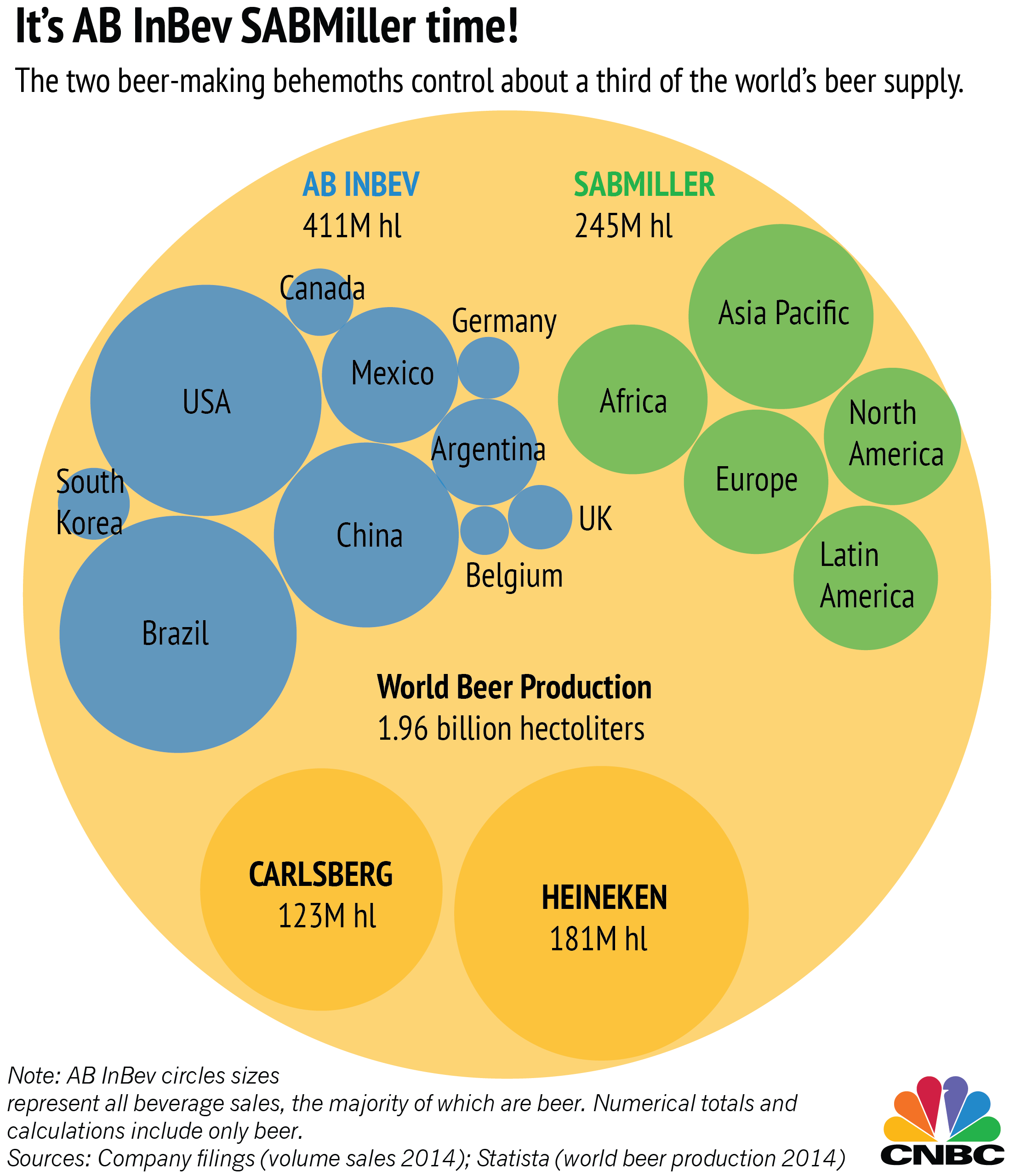

The deal needs to be approved by regulators, and would make Belgium's AB InBev, the world's largest brewer, even bigger and would give it a jump in emerging markets. It could mean rising beer prices around the world. Together, the company would dominate global beer sales with nearly 30 percent market share, three times its next rival, Heineken.

One of London-based SABMiller's major selling points is that it offers AB InBev overseas expansion possibilities. Forty-three of SABMiller's 210 brands are in Africa, according to the company's website. Thirty are in Latin America.