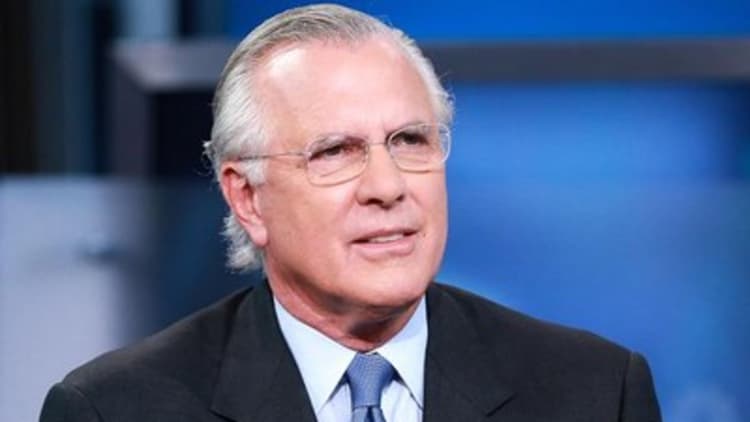

Former Dallas Federal Reserve Bank President Richard Fisher said Tuesday the Fed should heed the call of central bankers around the world and get on with hiking interest rates.

"I love my colleagues. You know that. I love the process of the FOMC, but they have egg all over their face," he told CNBC's "Squawk Box," referring to the Federal Open Market Committee, the Fed's policymaking body.

"Uncertainty is the enemy of decisionmaking. We know that as business people. Make a decision. Act on it."

The FOMC last month declined to raise interest rates, in part due to concerns about the potential for weakness abroad to spill over into the U.S. economy.

Read More Time to stop this focus on inflation

Emerging markets would face the prospect of higher prices and increased cost of servicing debt following a Fed liftoff. Investors typically flock to U.S. debt when rates increase. That weakens currencies in developing nations and leads to inflation.

But some central bankers at an International Monetary Fund meeting in Lima, Peru, said they would prefer the pain of a rate hike to the uncertainty that is clouding the Fed's interest rate policy, The Wall Street Journal reported. The IMF itself has come out against a rate hike, saying it could derail emerging markets.

Fed Vice Chair Stanley Fischer said Sunday in Lima he still expects the FOMC to begin raising rates at one of the committee's two remaining meetings this year, though he once again raised the specter of contagion from sluggish economic growth overseas.

Read More Fed's Fischer says 2015 US rate rise 'an expectation, not a commitment'

The Fed must act by year-end, or else it will create more uncertainty, Richard Fisher said. He added that recent statements from Fed Chair Janet Yellen, Fischer, and New York Fed President William Dudley suggest the central bank will move.

"They're all saying the same thing. They're either trying to talk the market into discounting it, or it's a head fake. And if it's a head fake, I think it's a terrible mistake," he said.

Drew Matus, deputy chief U.S. economist at UBS, also said the Fed risked injecting increased uncertainty into markets. He noted that the Fed has blamed lawmakers for creating economic drag by failing to pass fiscal reform measures and by creating uncertainty during debt ceiling showdowns on Capitol Hill.

"Well now the Fed's the source of uncertainty in the marketplace, and they don't seem to be able to recognize it when it's coming out of their own house," Matus told "Squawk Box" on Tuesday.

Once the Fed initially raises rates, the economy will accelerate through the first couple rate hikes, giving the Fed a "better and more stable" platform from which to continue moving toward interest rates that are more in line with historical norms, Matus said.

"If the Fed doesn't move, I think the economy gets worse, not better," he said.