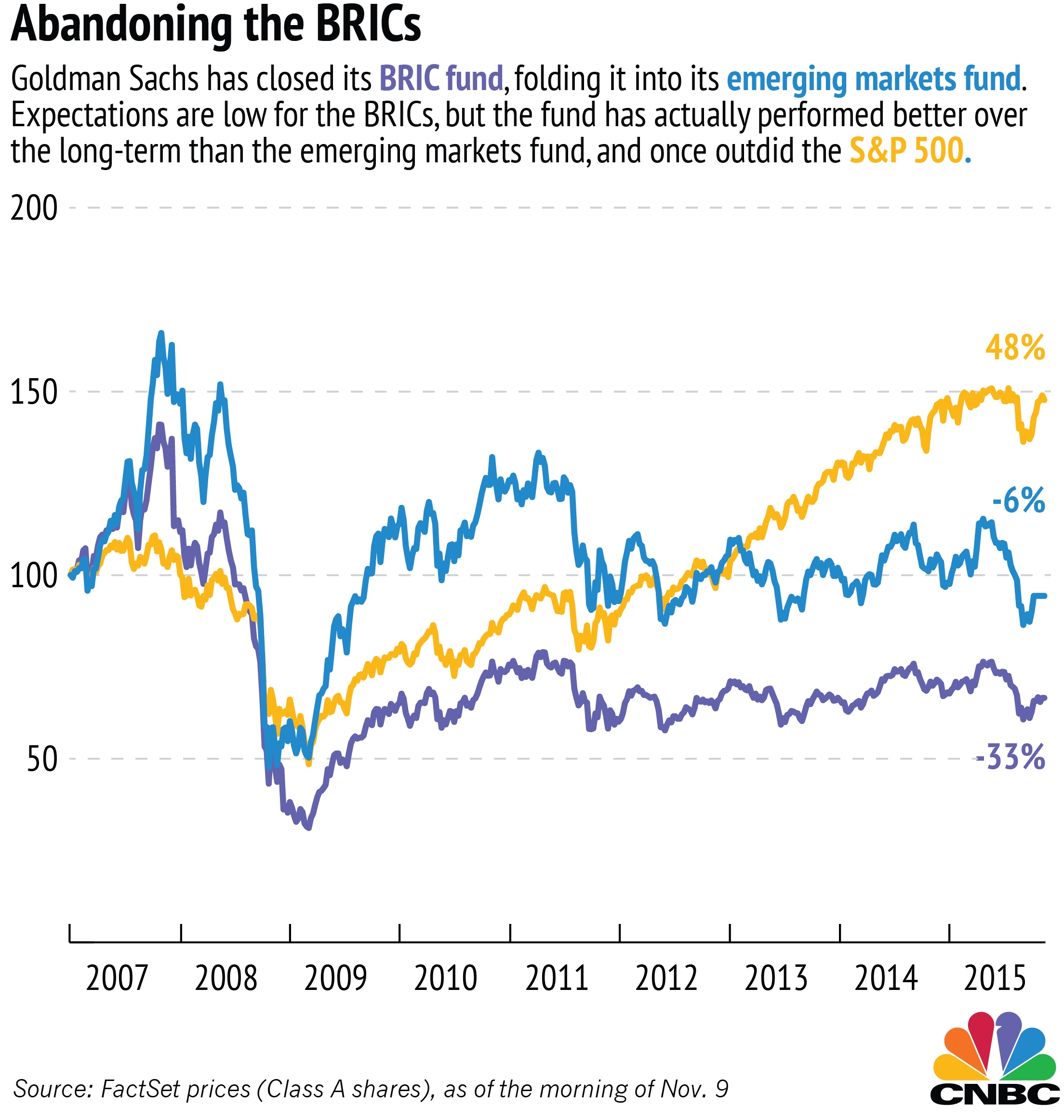

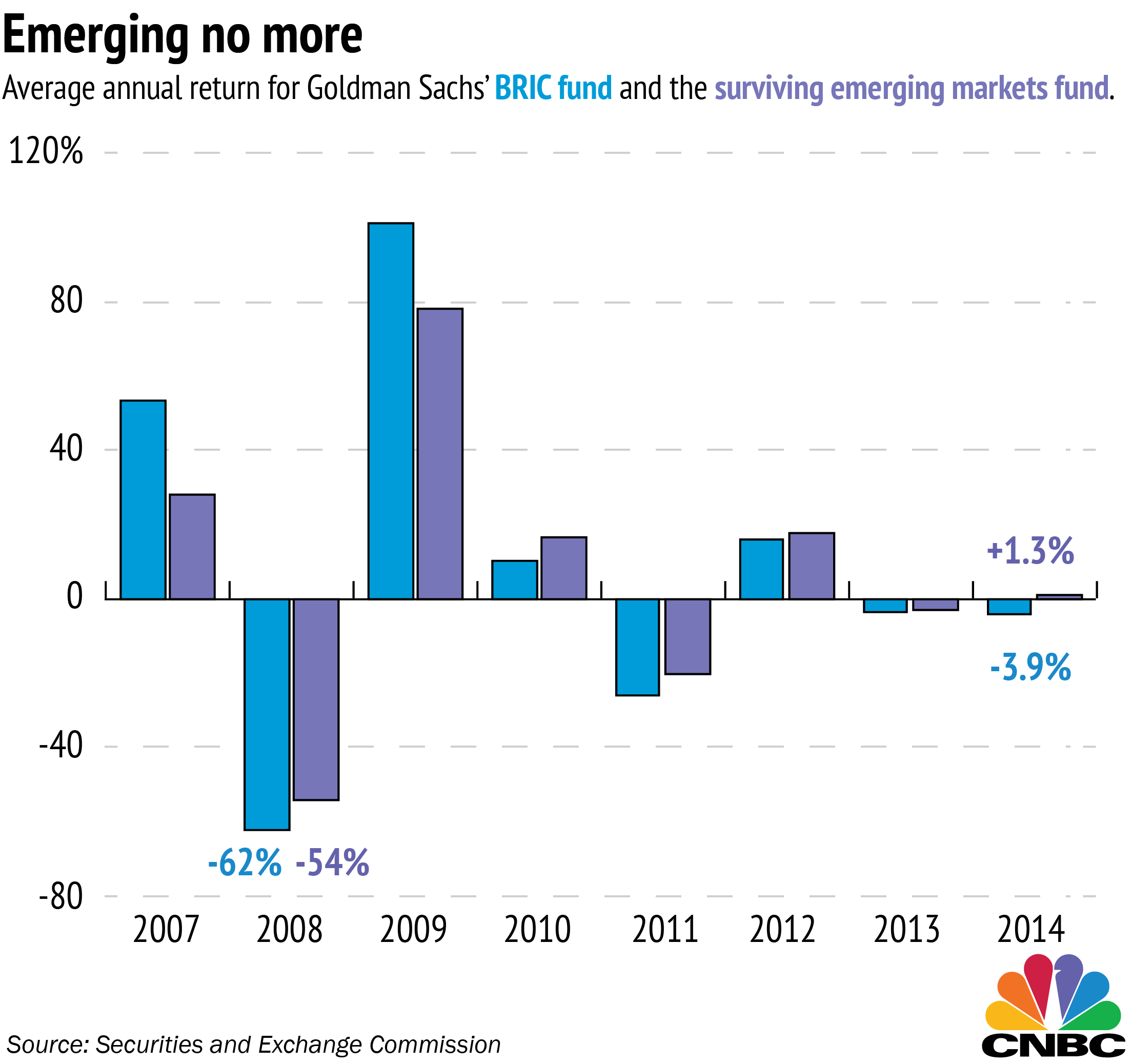

Goldman Sachs marked the end of era with the closing of its BRIC fund.

The fund's about $100 million in assets — selectively invested in the emerging markets of Brazil, Russia, India and China — were folded into the more diversified $322 million emerging markets equity fund. Bloomberg reported this week that Goldman quietly filed to close the fund in September.

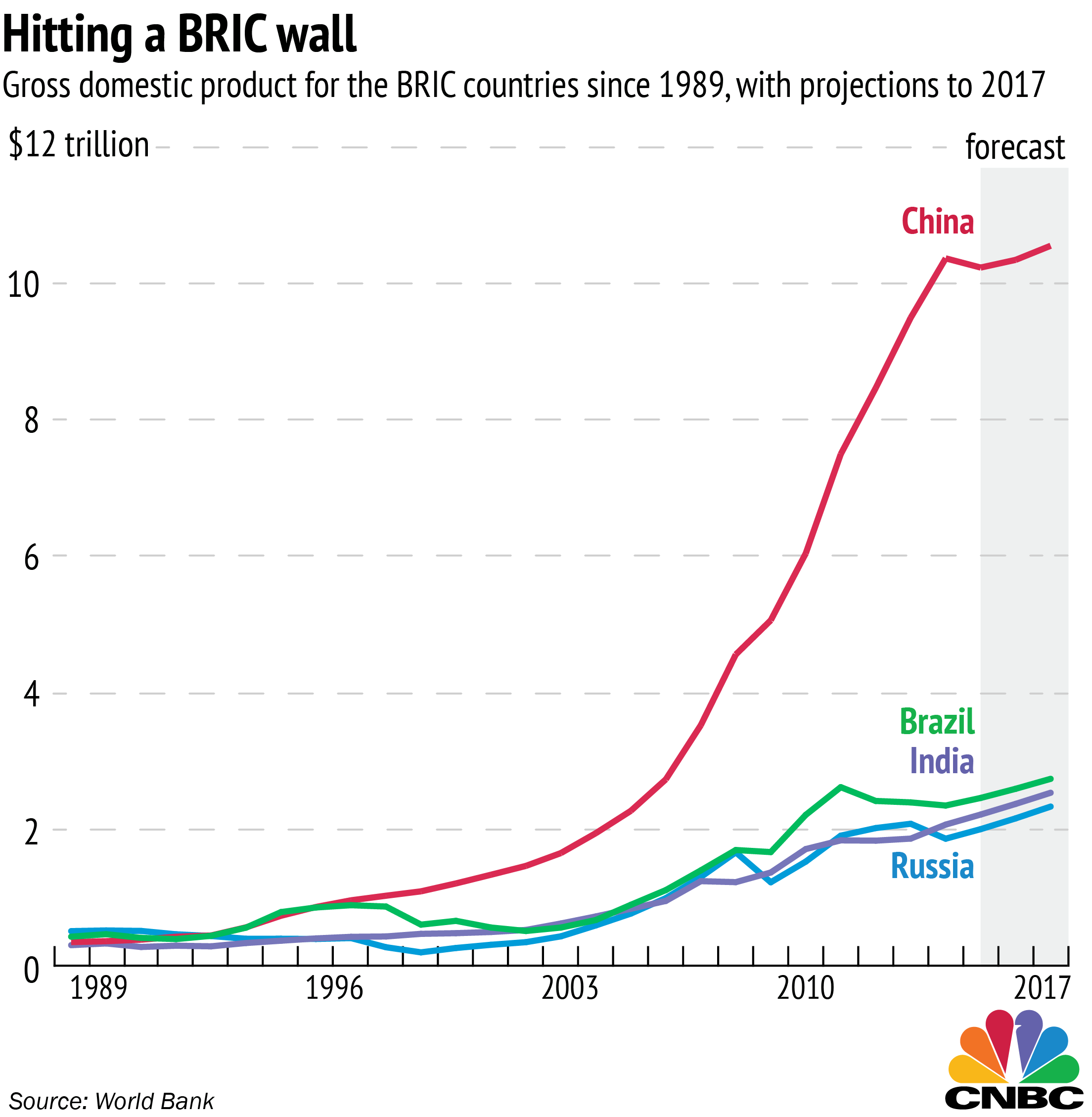

Despite the rapid economic expansion in those countries over the last 15 years, growth is expected to slow in coming years, according to World Bank estimates.