European equities close lower Monday, as investors around the globe mulled weak Chinese trade data and the increasing possibility of an interest rate hike by the U.S. Federal Reserve next month.

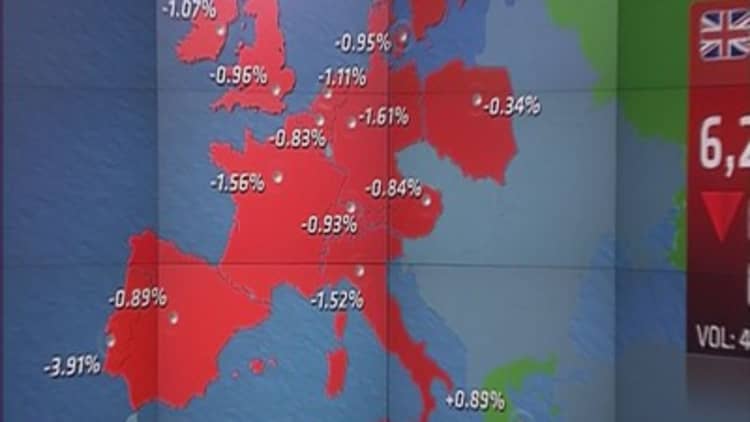

The pan-European STOXX 600 closed lower by around 1.1 percent, with most European indexes and sectors in the red.

The U.K.'s FTSE 100 closed provisionally down by 1.0 percent, with the French CAC 40 and the German DAX ending unofficially down 1.6 percent.

European markets

Data on Friday showed U.S. nonfarm payrolls increased 271,000 in October, in the largest gain seen since last December. The U.S. unemployment rate fell to 5.0 percent, the lowest since April 2008.

The data has increased the likelihood of a rate hike in December, causing U.S. equities to trade sharply lower on Monday.

In Asia, Chinese stocks jumped to their highest levels since late August, after the world's second-biggest economy released weak trade figures on Sunday.

China's October exports fell 6.9 percent from a year ago, dropping for a fourth month, while imports slipped 18.8 percent, leaving China with a record high trade surplus of $61.64 billion, the General Administration of Customs.

Back in Europe, shares of energy companies like Tullow Oil and Premier Oil rose well over 3 percent, even after a rebound in oil prices proved short lived.

In earnings news, Aggreko reported a fall in third-quarter sales, but also said that it had won a tender process to supply power to Guam. This saw shares close around 3 percent higher.

Auto part and tire maker Continental raised its full-year profit outlook after it saw a rise in third-quarter sales, but shares closed down by around 5.3 percent.

Shares in Lufthansa closed over 3 percent lower after it cancelled hundreds of flights for Monday amid a continued strike by cabin crew.

Intercontinental Hotels Group shares closed around 4.8 percent lower after the firm denied it was considering a potential merger or sale.

Shares of endangered Lonmin crashed 18 percent to the bottom of the STOXX 600 after it priced its $407 million rights issue at a 94 percent discount. The platinum producer has urged shareholders to approve the equity cash call, which it says it critical to its survival.

In terms of broader economic data, German exports and imports rebounded in September after plunging in the previous months. Exports rose 2.6 percent month-on-month while imports were up 3.6 percent.

Elsewhere, Portuguese stocks came under pressure, with the PSI 20 index closing over 4 percent lower. This comes as the center-right ruling party faces a vote that may topple it and put economic reforms and euro zone commitments at risk.