A "very large majority" of the governing council at the European Central Bank (ECB) voted in favor of the stimulus measures announced Thursday, according to the central bank's vice president, who has told CNBC that investor expectations had been wrong in the run up to the policy meeting.

"We have to recognize that the markets got it wrong in forming their expectations. They did indeed have higher expectations than were there and that's why they reacted like they reacted but that was not our intention," ECB Vice-President, Vitor Constancio told CNBC in Frankfurt.

"After our meeting in October we said that we would reassess the degree of accommodation so we were talking about a recalibration of our measure. We were not talking about, ever, about a new type of QE2 or something like that. That's not what we were talking about."

Constancio said that he believed the "fault lies with the markets" after Thursday's heavy sell-off in equities, and rejected the view that the ECB had lost some credibility over the guidance that it gave before the announcements.

"They (market participants) should have thought in our wording that in October where we said we are going to reassess the degree of accommodation, so it was all the time about recalibration, it is not about a big change in policy," he added.

"Perhaps many (market participants) were hoping to, you, know, make some money if there would be a big event. But, indeed they got it wrong."

Read the full transcript of the interview here.

More in the toolkit?

The ECB announced a number of changes to its asset purchase program on Thursday in an effort to fend off sluggish inflation and boost lackluster growth.

It cut its key deposit rate further into negative territory and President Mario Draghi said the bank would extend its massive 60 billion euro ($63.5 billion) a month bond-buying scheme to at least March 2017.

The ECB will also reinvest the principal payments on the securities purchased under the quantitative easing plan, which he said will help liquidity conditions as well as including regional and local euro area debt in the program.

Constancio added Friday morning that this reinvestment of payments would mean the central bank would still be supporting the economy beyond the March 2017 date.

Market disappointment

The central bank Thursday stopped short of expanding the amount of bonds purchased by the bank each month. This disappointed market watchers who were also anticipating a deeper cut to interest rates.

The euro jumped sharply against the dollar, trading at $1.0910 after shooting up 3.1 percent overnight, its biggest one-day gain since March 2009. Equities in the region slumped, with the Euro Stoxx 600 benchmark closing 3.1 percent lower on Thursday.

Analysts were left questioning whether Mario Draghi had been reined in by the more hawkish members of the ECB at the latest policy meeting. Jens Weidmann, a governing council member and the president of Germany's Bundesbank, argued on Thursday evening that the latest round of monetary easing from the bank was not needed.

In an interview with German newspaper Bild he said that the latest economic data confirmed his view that the sharp decline in energy prices supported the single currency region's economic recovery and that the close to zero inflation is in great part due to the low oil price.

"President Weidmann was and still is confident for the economic recovery in the euro zone and therefore expects inflation rate to go back towards levels consistent with our definition of price stability," the Bundesbank said in a statement sent to CNBC.

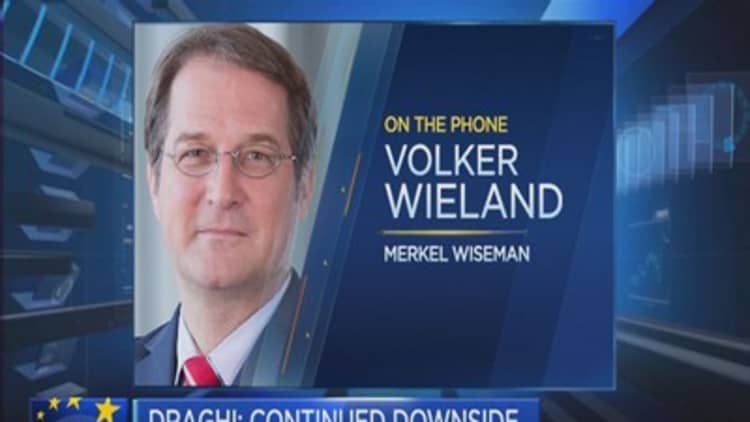

German Council of Economic Experts member Volker Wieland backed these views when speaking to CNBC on Friday morning. he said that the whole case for additional easing was being overplayed and believes that the stimulus should be scaled back.

—CNBC's Jenny Cosgrave contributed to this article.