Two major bits of news this week showed in stark numbers the direction of the American economy.

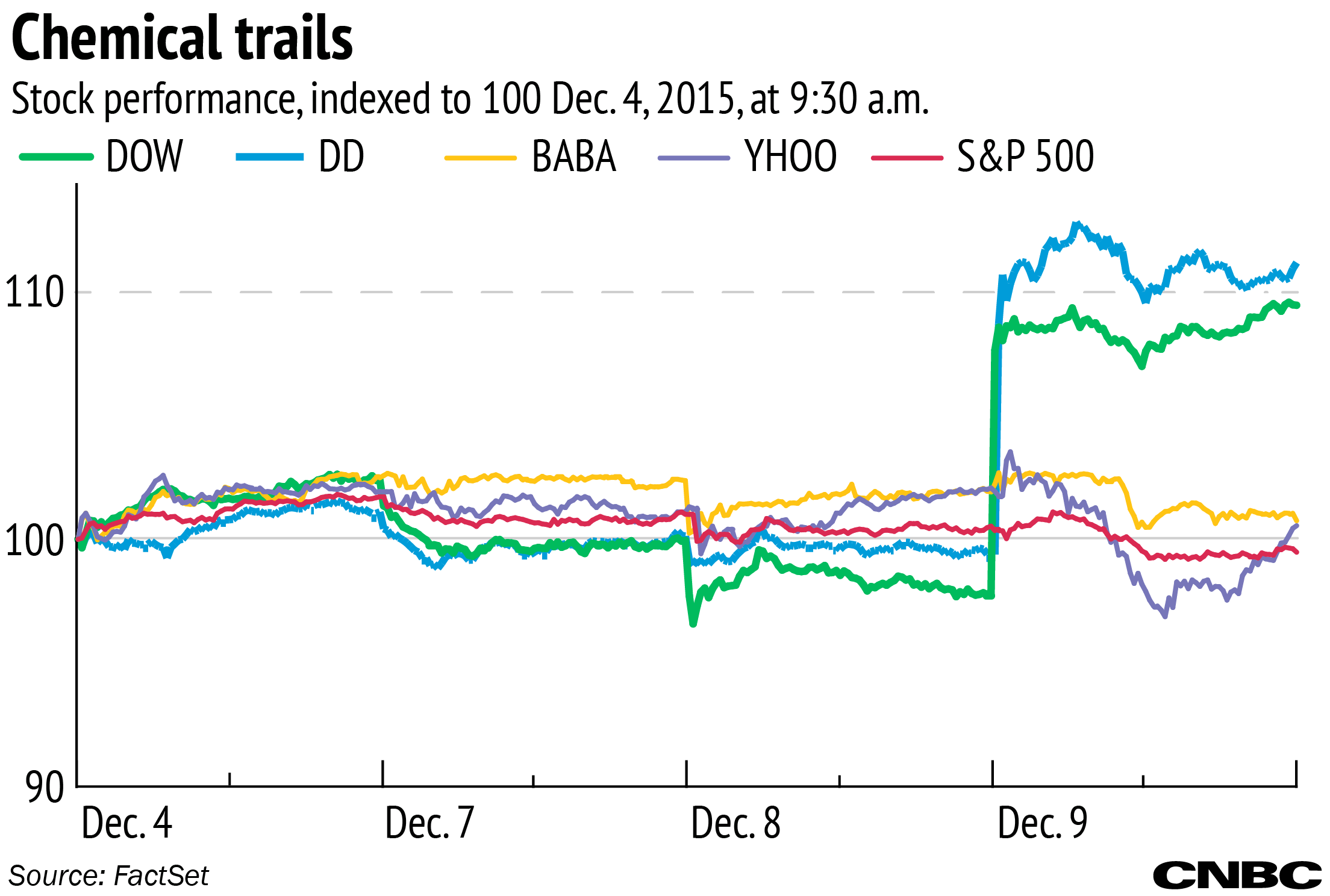

First, a major player in the tech realm reversed its year-long course to spin off its share of an e-commerce site. Then two of the nation's oldest companies announced a merger that would create the world's second-largest chemical company.

Yahoo's decision to split off its core business into a new company and maintain its stake in Alibaba generated 80,000 hits on Google News in the past week. At the same time, the merger deal between Dow and DuPont — two companies with nearly 350 years experience between them — had only 44,000.

The companies confirmed the planned deal Friday. The combined company would be valued at $130 billion.