The Federal Reserve may be raising interest rates Wednesday, but that's only the first step in what's bound to be a long return to normalcy.

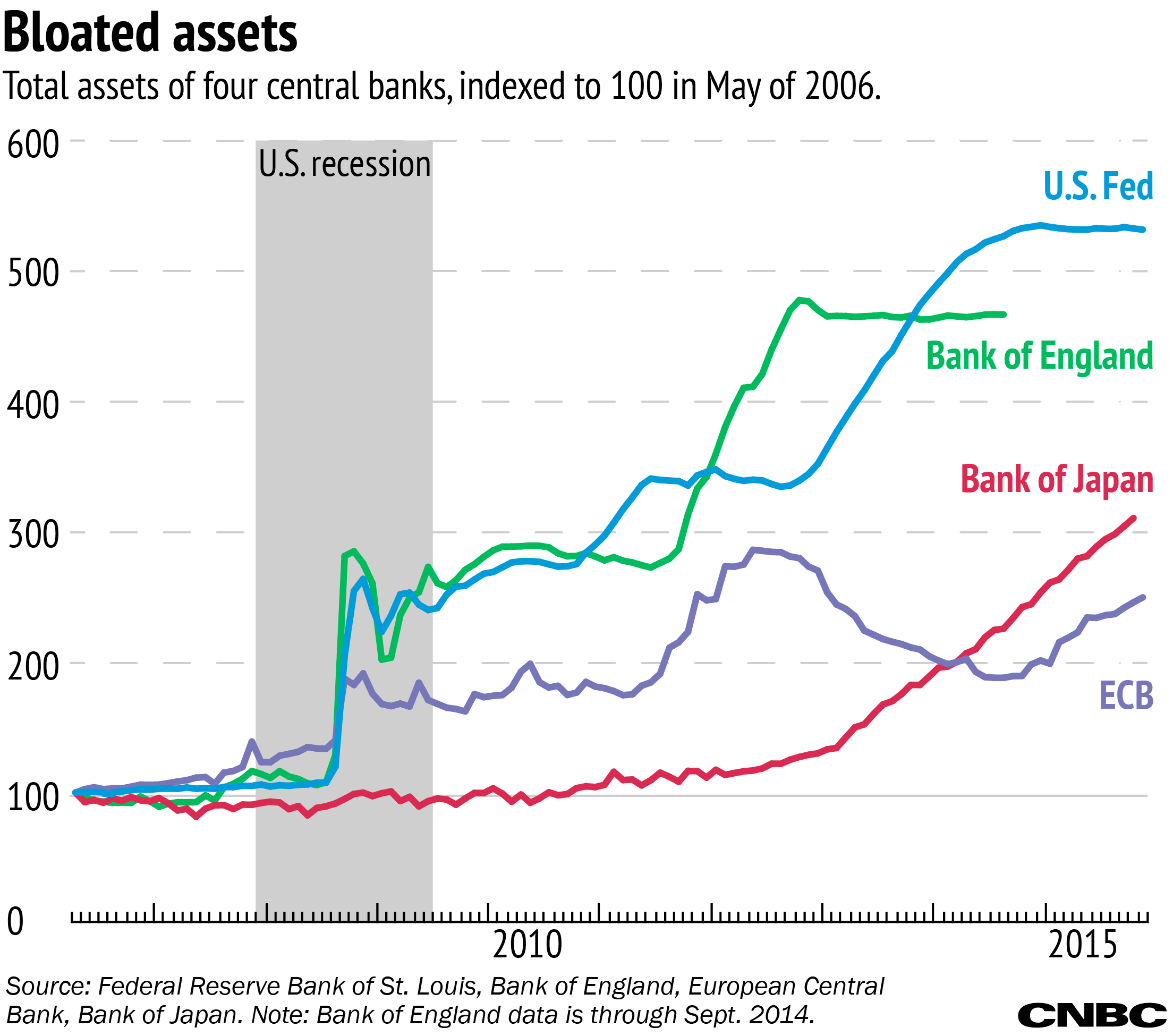

The central bank will also have to decide what to do with the massive assets it picked up during the recession. Specifically, $4.5 trillion, mostly in Treasury notes as well as mortgage-backed securities that were bought up in an attempt to absorb some of the toxic assets.

The unconventional monetary policy of adding trillions to the balance sheet will require some unconventional methods of spending down. We thought we'd help Janet Yellen out and find out what $4.5 trillion could buy you.