U.S. stocks closed higher after the Federal Reserve raised rates for the first time in nearly a decade. Only the energy sector lagged as oil prices resumed their decline.

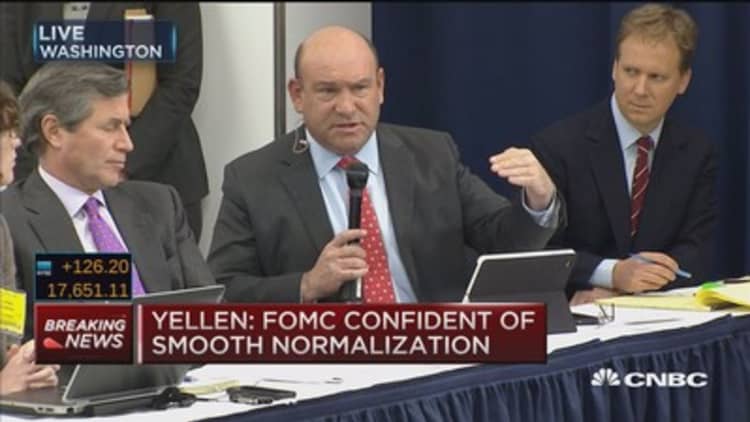

The major averages extended gains after Fed Chair Janet Yellen said in a press conference that policy would remain accommodative and that the significance of the first hike should not be overblown.

"I think the market heard what it wanted to hear and that should bode well here for '15 and the first month of '16," said Tom Siomades, senior managing director and head of Hartford Funds Investment Consulting Group.

One-month performance

The Dow Jones industrial average ended up about 224 points after earlier adding 250 points with Goldman Sachs contributing the most to gains. In morning trade prior to the Fed's decision, the Dow added as much as 165 points before briefly turning negative.

The S&P 500 ended slightly off session highs with gains of about 1.45 percent, in positive territory for the year so far. The index posted its first three-day win streak since October.

Oil traded lower Wednesday after two days of recovery from near-seven-year-lows. U.S. crude oil futures settled at $35.52 a barrel, down $1.83, or 4.90 percent, after weekly EIA crude inventories showed a rise of 4.8 million barrels.

Leading S&P sector advancers, utilities jumped more than 2.5 percent for its best daily performance since March. Energy was down about half a percent as the only decliner.

"We remain in an environment where interest rates remain pretty moderate and that bodes well for utilities," said John Bartlett, co-portfolio manager of the Reaves Utilities ETF (UTES).

Treasury yields held just below or near session highs, with the crossing 1 percent for the first time since 2010. The 10-year yield hit a high of 2.33 percent, its highest since Dec. 4. The hit a high of 1.776 percent, its highest since Dec. 4.

Read MoreInterest rate hike: What you need to know

The U.S. dollar index held about 0.2 percent higher, after a brief dip following the Fed decision. The euro briefly fell below $1.09 after temporarily topping $1.095.

"I think the bond market will still call the bluff on the Fed's projections. They're being a little more hawkish right now than they will actually be next year," said John Caruso, senior market strategist at RJO Futures.

As most expected, the U.S. central bank raised its target funds rate by a quarter point, while emphasizing a gradual and data-dependent pace of future tightening. Wednesday's hike was the first since June 2006.

Read MoreFed sees rates around 1.375 percent at end 2016

"Markets have not been caught off guard," said Eric Lascelles, chief economist at RBC Global Asset Management.

"I'll be curious to see how it plays out over the next couple days but I think it would be positive," he said.

"The key takeaway from (the Fed today is) rates are going to remain low. The interest rate path, despite the first tightening, is going to remain gradual," said Krishna Memani, CIO at OppenheimerFunds.

Read MoreFed gives step-by-step plan for raising rates

He said he "expects volatility the moment the economy strengthens because investors are going to expect the Fed tightens more (quickly)."

In economic news, housing starts rose 10.5 percent in November, while building permits rose 11 percent. Mortgage refinances rose 1 percent on rate fears.

U.S. industrial production saw its sharpest decline in more than three and a half years in November as utilities dropped sharply, a sign of weakness that could moderate fourth-quarter growth. Industrial output slipped 0.6 percent after a downwardly revised 0.4 percent dip in October, the Federal Reserve said in a Reuters report Wednesday, marking the third straight month of declines. Capacity utilization was 77.0 percent.

December Flash Manufacturing PMI fell to from November to 51.3, the weakest improvement in manufacturing sector business conditions in three years, Markit said.

Read MoreOil at $100? 'Outrageous' forecasts for 2016

Trading has been volatile in the last several days as traders weighed sharp declines in oil prices, seasonal tax-loss selling and anticipation of quadruple witching expiration Friday as the year-end approaches.

Other commodities traded mixed, with copper and gold higher but natural gas near lows not seen in more than a decade.

"That's one of the scary things for individual investors here is that time horizon (fifteen minutes versus the long-term)," LPL Financial Investment Strategist and Economist John Canally said ahead of the Fed's decision. "Our view is you probably don't want to react to any near-term movements."

He was keeping an eye on currencies and emerging market ETFs.

The iShares MSCI Emerging Markets ETF (EEM) ended nearly 2 percent higher for its best day since early November, but is still down about 15 percent year-to-date.

Major U.S. Indexes

Global equities rallied ahead of the Fed announcement, with Japan's Nikkei 225 closing up 2.6 percent and European stocks paring gains but ending higher.

U.S. stocks closed higher Tuesday, supported by stabilization in oil prices and high expectations for the first rate hike in nine years.

The major U.S. averages are on track for weekly gains of roughly 3 percent.

Read MoreEarly movers: VRX, JOY, AMGN, CVS, P, AMC, HAL, BH & more

The Dow Jones industrial average closed up 224.18 points, or 1.28 percent, at 17,749.09, with Goldman Sachs leading advancers and Exxon Mobil and DuPont the only decliners.

The closed up 29.66 points, or 1.45 percent, at 2,073.07, with utilities leading all sectors except energy higher.

The Nasdaq composite closed up 75.77 points, or 1.52 percent, at 5,071.13.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, held above 17.5.

About five stocks advanced for every decliner on the New York Stock Exchange, with an exchange volume of 1.0 billion and a composite volume of nearly 4.6 billion in the close.

Gold futures settled up $15.20 at $1,076.80 an ounce.

On tap this week:

Thursday

8:30 a.m.: Initial claims; Current account

8:30 a.m.: Philadelphia Fed survey

10 a.m.: Leading indicators

10:30 a.m.: EIA natural gas inventories

4:30 p.m.: Fed balance sheet/money supply

Friday

9:45 a.m.: Services PMI

10 a.m.: Atlanta Fed biz inflation expectations

11 a.m.: Kansas City Fed manufacturing index

1 p.m.: Richmond Fed President Jeffrey Lacker speaks on economy

*Planner subject to change.

More From CNBC.com: