As investors prepare for 2016, they should keep in mind what's going on in U.S. manufacturing, Wells Fargo Securities' Mark Vitner said Thursday.

"If the year gets off to a slow start, like it has the last couple of years, it's likely due to some additional slowing in manufacturing. All of the forward-looking data on manufacturing is still pointing to further deceleration," the firm's senior economist told CNBC's "Squawk Box."

"A lot of people have minimized the troubles of the factory sector … but it still accounts for the bulk of the swing in GDP from quarter to quarter."

Overall, U.S. economic data for 2015 have been mixed, but the nation's manufacturing sector has taken several hits this year.

"That's the one concern I have at the onset," Vitner said. "The orders data look horrible, and we really haven't had much growth in our industrial production for the last year."

The mixed U.S. data, along with a strong dollar and a massive plunge in oil prices, have taken their toll on the equities market. In fact, the benchmark index was up only 0.22 percent year to date ahead of Thursday's open. It was lower in early trading.

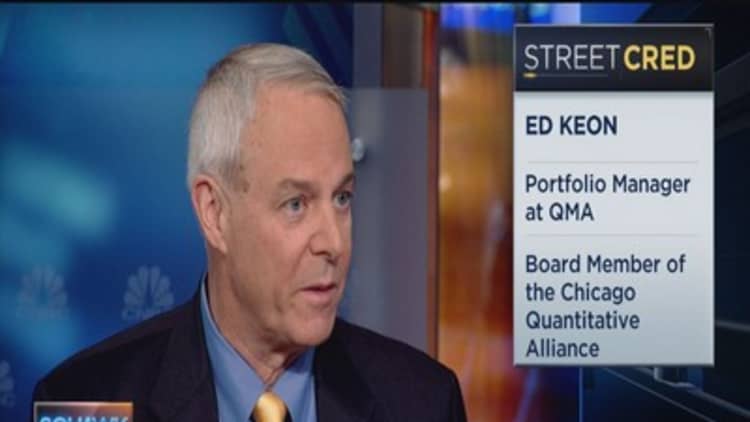

Many analysts and strategists see another flatish year for the S&P in 2016, including Ed Keon, managing director at Quantitative Management Associates.

"Frankly, we're in the consensus. 2016 will be a tough year. I can think of some scenarios where it might be a good year, but I think the most likely outcome is that we get relatively weak earnings growth again ... and that we eke out some positive returns, but they're not going to be terribly exciting," he said Thursday in another "Squawk Box" interview.

However, Larry Glazer of Mayflower Advisors, sees it differently.

"2016 is going to be a very different year. It's going to be the year of the underdog. It's going to be the year the Force triumphs over the Evil Empire," he told "Squawk Box." "In 2016, you won't see those big, mega-growth names because the market is just so narrow."