China tested its new system-wide circuit breaker last night. The good news is it works. The bad news is the circuit breakers themselves may be part of the problem.

First, the new system-wide circuit breakers take effect when there is a 5 percent decline in the market (the benchmark CSI 300), which creates a 15-minute halt. If the market drops 7 percent, the market closes for the day. Hong Kong has no circuit breaker.

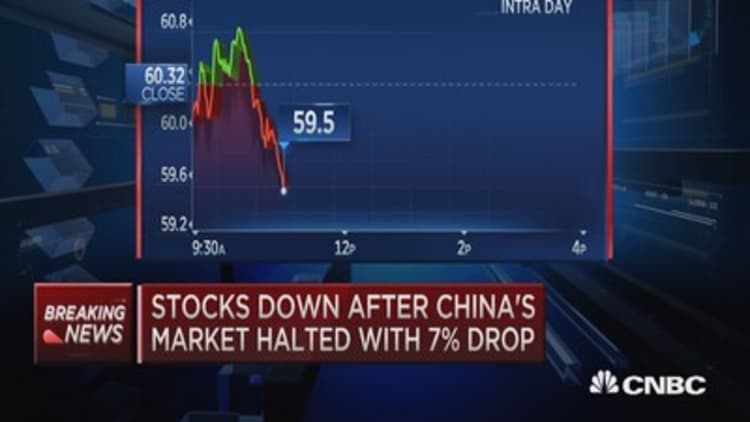

After hitting the limit of 5 percent and reopening after 15 minutes, it took roughly two minutes to hit down 7 percent, which triggered the final halt and closed the market.

What caused the decline? The December manufacturing PMI survey was 48.2, slightly below expectations but still the 10th straight month of contraction, but it's unlikely that was the primary cause of the problem. Besides, the non-manufacturing (service) numbers were strong.

Read MoreChinese markets halt trading for day after shares plunge

Most traders pointed to the proposed lifting of insider selling allowed on previously halted stocks, which is scheduled to take effect this Friday. This will mostly affect small cap stocks, most of which are listed on the Shenzhen exchange. Shenzhen was down 8.2 percent, its worst day since 2007.

That may be the likely answer, but don't dismiss the very existence of the circuit breakers as a factor in the drop. This was the first day the circuit breakers came into existence, and given the speed at which we went from down 5 percent to down 7 percent (about two minutes) general worry that the market would close before the end of the day—which is what happened—may have been a very real factor.

My bet is that the Chinese authorities will widen the bands. China's stock market is far too volatile for a 5 percent halt.

Look at the system-wide halts the United States uses. The U.S. system-wide circuit breakers were revised in 2012. The market will halt for 15 minutes if the drops 7 percent, and then 13 percent before 3:25 p.m. ET. A similar decline after 3:25 p.m. will not halt trading.

Read MoreGlobal markets slump after China falls 7%

A decline of 20 percent or more will halt trading for the entire day, regardless of when it occurs. These system-wide circuit breakers were only triggered once in the United States, on Oct. 27, 1997.

My bet is that the Chinese will move closer toward the U.S. system of halting for the day only if the market drops 20 percent, rather than 5 percent.