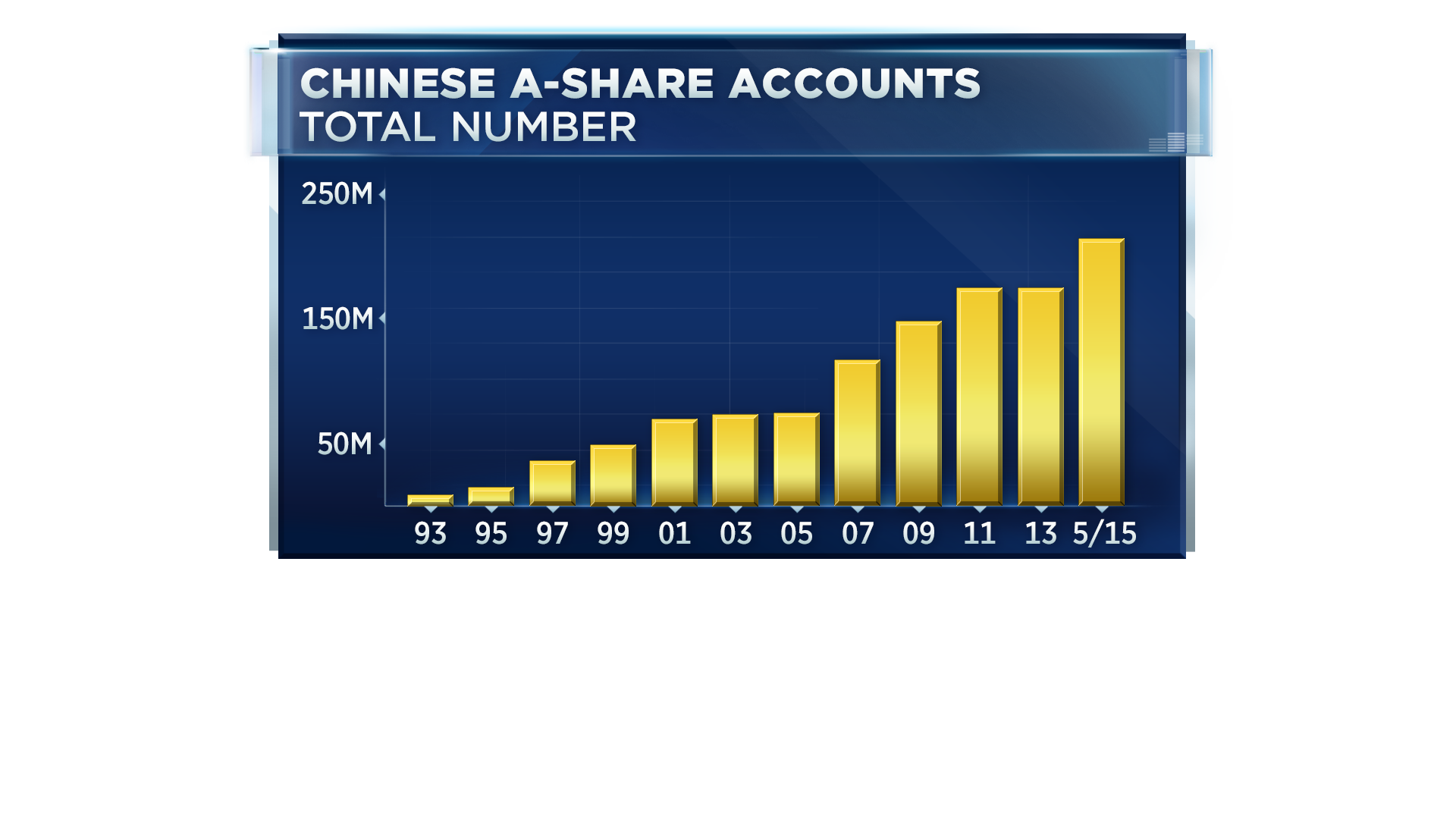

The one thing to remember about the Chinese stock market is that it operates so differently from U.S. and European markets. First off, the China market is dominated by retail investors, who treat it very much like a casino. Look at this chart:

There are more than 200 million trading accounts in China. That's the same size as America's adult population. And that's one of the main reasons we're seeing so much volatility. FIS Group in a recent report said that more than 90 percent of capital accounts are owned by retail investors, suggesting the wild moves in Chinese stocks is primarily driven by "their market structure" and "trade momentum."

Even though we've seen huge drops in the last week, let's not forget how massive the spikes up have been in the past 10 years. Chinese stock market volatility makes the S&P 500 look almost like a flat line.

Another way to see it: the difference between small and large caps.

Of course small caps anywhere tend to move more than large caps — but in China, that difference is bigger, especially in the past months.

Remember, many Chinese large-cap stocks are primarily state-owned enterprises, so retail traders generally look toward smaller companies to make their quick bucks.

Wu Jinglian, a veteran economist, has said comparing Chinese markets to a casino is actually unfair — to the casinos. He said that at least the casinos have stronger rules, and don't have price manipulation.

That's why when bad news in the economy happens, a spooked and scared set of retail traders will be much quicker to bail versus the more professionally dominated U.S. market.