China's economic growth rate slowed to a 25-year low of 6.9 percent in 2015, as the world's second-largest economy continues to shift away from its manufacturing roots.

China's economy grew 6.8 percent in the fourth quarter of 2015 from the same period last year, official data showed Tuesday.

The growth figures, still respectable by global standards, were in line with estimates for quarterly growth of 6.8 percent on-year, down from the third quarter's 6.9 percent, according to a Reuters poll, which also found economists expected full-year growth at 6.9 percent, down from 2014's 7.3 percent.

While secondary industry, or manufacturing, growth slowed to 6.0 percent in 2015 from 2014's 7.3 percent, tertiary industry, or the services sector, expanded by 8.3 percent last year, up from 2014's 7.8 percent. At the opening ceremony for the Asian Infrastructure Investment Bank on Saturday, Chinese Premier Li Keqiang said that China's economy grew about 7 percent in 2015, with services accounting for half of GDP.

"This is a good number," Jahangir Aziz, head of emerging Asia economic research at JPMorgan, told CNBC's Street Signs. "We've known for the last three years that the Chinese authorities are slowing down the economy. This economy is going to slow down," he said.

Others see signs of the economic rebalancing away from manufacturing and toward consumption and services.

"The growth picture remains two-sided. The real estate construction slump and weak exports continued to weigh on activity and prices in industry, especially heavy industry," Louis Kuijs, head of Asia economics at Oxford Economics, said in a note Tuesday. Oxford estimated that China's economy grew 6.3 percent last year.

"Meanwhile, though, consumption continued to expand robustly, supported by solid wage growth. This is supporting light industry and the service sector, where pricing power vastly exceeds that in heavy industry," he said.

The figures show "substantial rebalancing" in China's economy, but that's partly due to severe downward pressure on output prices in overcapacity sectors, Kuijs said.

But he added, "Notwithstanding the recent equity market turmoil, there are no signs of a more drastic slowdown."

He expects more government measures to keep GDP growth around the likely 6.5 percent target for 2016, including another interest rate cut, several reserve-requirement ratio cuts and expansionary fiscal policy.

JPMorgan's Aziz also expects a more-balanced view of China's economy ahead.

"In August, last year there was almost a fear that the economy was in free-fall. There was no policy support. I think all that has changed," Aziz said. "We will see the numbers going closer to 6.5 percent and more policy support. The policy setting has changed over the last two months. We're not going to see the kind of heartburn we saw last year."

Stock markets around the region initially climbed after the data's release, before quickly retracing gains. The Shanghai Composite climbed as much as 0.7 percent in the wake of the data, before retreating to trade flat, only to climb again later. Similarly, in Japan, the Nikkei tacked on as much as 0.78 percent, before sliding into negative territory.

To counter slowing growth, China's policy makers have taken a slew of easing measures, including interest rate and reserve requirement ratio cuts from the central bank, the People's Bank of China. Analysts are predicting further easing measures ahead to bolster the mainland's slipping growth rate.

There are a slew of concerns about the Chinese economy: The country is hooked on debt, the shadow banking sector has imploded, the property market sometimes shows signs of a bubble and major industries are slowing.

Those concerns have driven, at least in part, a sharp drop in China's stock markets recently. The Shanghai Composite has entered "bear within a bear" territory, falling more than 20 percent from its December high, as well as trading down more than 40 percent from its 52-week high set in June of last year.

As is usual with China's economic data, skepticism abounds.

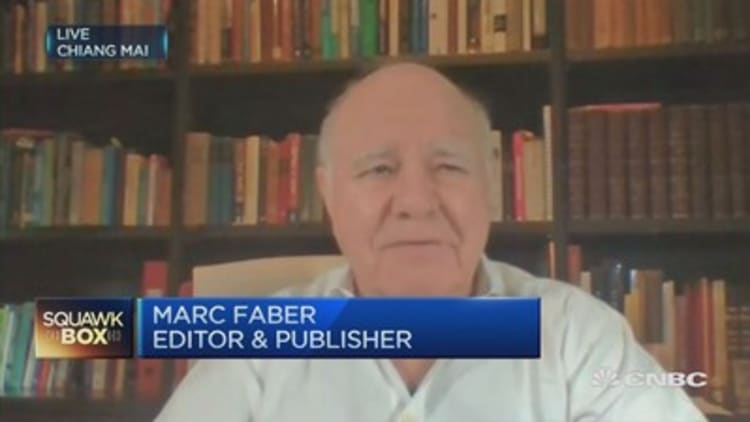

"Chinese statistics are really used to project some sort of perception. We know their statistics are not very accurate. Look at the economy fourth quarter. Electricity became more negative. Housing starts last year were about 14 percent down, so half of the economy is actually negative," Andy Xie, an independent economist, told CNBC's Squawk Box before the data were released. "The economy is not growing much, possibly not in recession, but certainly not growing at 6-7 percent."

China's power generation last year dropped 0.2 percent from 2014, the first annual decline since 1968, during the Cultural Revolution, Reuters reported.

But JPMorgan's Aziz noted that other data are indicating growth.

Retail sales, for example, rose 11.1 percent on-year in December, although that missed expectations from a Reuters poll for an 11.3 percent rise.

"If you look at the other services sectors -- healthcare, education, financial services -- financial services did get a bad name after the margin financing crash in the first half of the year, but if you look at insurance and bank net margins, I really don't think you need to look too hard, but you need to look for areas within China that are growing outside of the old China," Azis said. "I think people aren't taking the new China seriously."

—By CNBC.Com's Leslie Shaffer; Follow her on Twitter @LeslieShaffer1