Despite crude oil's 4 percent rally this week, one technician who saw the January swoon in stocks coming sees a long, bearish road ahead for the commodity.

"We've moved from $27 to $34, about a 25 percent move off the low, but we're still moving in a downtrend," Cornerstone Macro's Carter Worth told "Fast Money" traders last week. "Bottoms look a certain way—they don't look like this."

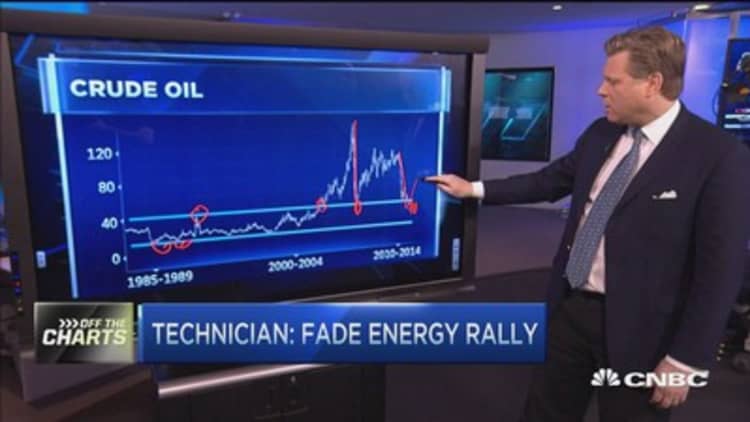

Crude has fallen 70 percent since its 2014 highs and any rally we see in the commodity, Carter says, "is simply a counter-trend rally in an ongoing downtrend."

According to Worth, when you trace crude's range back to the 1980's, crude has steadily traded in a $10-$40 range for nearly 20 years. In the two most recent crashes, 2009 and the most recent, crude has broken back through the $40 "ceiling"—something worthy of note.

"There's every possibility that we're stuck here," Worth said. "But the notion that we're going to have some big rebound again—there's nothing to suggest that."

As far as the best way to play crude's meltdown, Carter suggests to continue to be bearish of energy and energy stocks. Most importantly, fade all rallies.

When you take a look at a chart of the S&P 500 and the Energy Sector ETF (XLE), the divergence that began back in 2003 is finally coming to an end. For that reason, it would be wise to stay away from the sector until crude's path is solidified, Carter argued.

"There's plenty of time to figure out if crude is turning higher," Carter said. "For now we have to make sure it's not going lower."

Worth has a history of making both bold and accurate market calls. When stocks were approaching record highs in 2007, he appeared on Fast Money and said the bull market was over. More recently, he appeared on Fast in September and declared the recent bull market over.