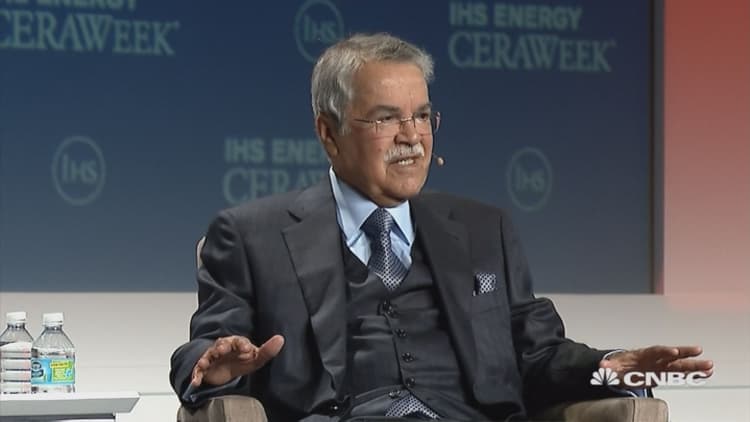

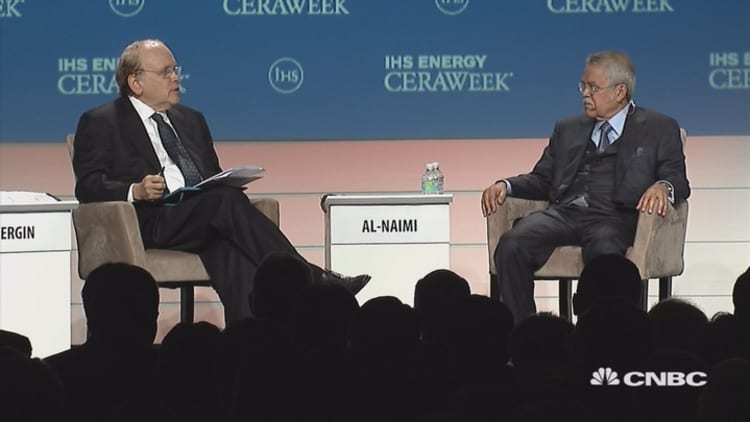

Saudi oil minister Ali Ibrahim Al-Naimi said Tuesday producers will hopefully meet in March to negotiate an output freeze, but production cuts will not happen.

Last week, Saudi Arabia, Russia, Qatar and Venezuela proposed a freeze that would cap production at January levels. Russian Energy Minister Alexander Novak said Saturday the deal, which is contingent on other producers participating, should be finalized by March 1, Reuters reported.

"Freeze is the beginning of a process, and that means if we can get all the major producers to agree not to add additional balance, then this high inventory we have now will probably decline in due time. It's going to take time," Naimi said.

"It is not like cutting production. That is not going to happen because not many countries are going to deliver even if they say they will cut production — they will not deliver. So there is no sense in wasting our time seeking production cuts," he added.

There is now less trust than normal among the world's oil exporters, he said.

Naimi made his comments following a keynote speech at the IHS CERAWeek conference in Houston, his first U.S. appearance since Saudi Arabia led OPEC's current high production policy more than a year ago.

Asked by CNBC whether he believed speculation about an output cut would continue to affect the price of oil, he declined to comment.

Oil prices had surged on the prospect of OPEC and non-OPEC members capping production, but the rally stalled on Tuesday on doubts that a freeze would significantly reduce oversupply.

On Monday, OPEC Secretary General Abdalla Salem El-Badri told CNBC that oil producers are still "feeling the water" over a possible deal to freeze production, and it is "wait and see" as to whether it leads to any other type of deal.

Naimi said there is more to unite energy industry participants than to divide them, but lack of consensus led OPEC to embark on a policy that has sent prices spiraling.

Oil prices have cratered more than 70 percent since mid-2014 as near-record global oil production created a massive crude glut.

The rout accelerated after OPEC announced in November 2014 it would not cut production to prop up prices. Instead, members have continued to pump unabated in a bid to defend market share and pressure higher-cost producers.

Naimi disputed the idea that Saudi Arabia was trying to capture more market share. He said the Saudis were simply meeting the demand of their customers.

"The oil market is much bigger than OPEC. We tried hard to bring everyone together — OPEC and non-OPEC — to seek consensus. There was no appetite for sharing the burden, so we left it to the market as the most efficient way to rebalance supply and demand," Naimi said.

"We have not declared war on shale or on production from any given country or company, contrary to all the rumors you hear and see," he said, referring to the U.S. fracking industry. A boom in U.S. shale oil contributed to a market that is estimated to be oversupplied by about 1 million to 2 million barrels per day of oil.

Analysts have also speculated that the Saudis want to punish Russia, which relies on taxes from oil revenues to fund its government. Russia has supported Saudi Arabia's regional rivals, including Iran and Syrian President Bashar Assad.

"We are doing what every other independent representative in this room is doing. We are responding to geology and market conditions and seeking the best possible outcome in a highly competitive environment," Naimi said.

The market will determine where on the cost curve the marginal oil production lies, he said. Drillers with higher costs must find ways to become more efficient, borrow cash, or liquidate, he added.

"Inefficient, uneconomical producers will have to get out. This is tough to say, but that is a fact," he said.

Naimi acknowledged that shale oil has a place in the industry's future. He said that while Saudi Arabia is studying shale production, it has no plans to produce the crude today because it has plenty of conventional oil reserves.

Naimi has been Saudi Arabia's minister of petroleum and mineral resources since 1995. Prior to that, he ran the state-run oil giant Saudi Aramco, which is believed to be the world's most valuable company.

Lower prices have forced Saudi Arabia's leaders to tap debt markets, draw down foreign reserves, pare back the budget, and announce subsidy cuts that have helped maintain domestic stability.

— CNBC's Patti Domm contributed to this story.