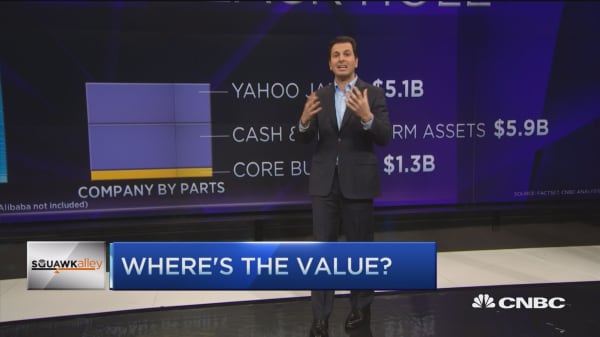

To be sure, Yahoo's core is surely worth more than the value currently assigned to it by the market. After all, Verizon bought AOL for $4.4 billion just last year, or about eight times earnings before interest, taxes, depreciation and amortization. At a similar ratio, Yahoo's core business would be worth about $6 billion or $7 billion. But even at that generous valuation, $10 billion in company value has been destroyed.

Where did that value go? Well, some of the companies Yahoo has purchased over the years were simply bad deals. Mark Cuban's broadcast.com, which was purchased for billions right before the dot com bubble burst, is probably one of those. Others may have contributed to the company but not enough to make a difference in Yahoo's deterioration.

CEO Marissa Mayer, who took control in July 2012, is responsible for only about 15 percent of those acquisitions, including the $1.1 billion purchase of Tumblr, which appears to be operating under a very light touch from Yahoo. Under Mayer's tenure, Yahoo has spent at least $2.5 billion on material acquisitions and sold $670 million — a basket of properties that are collectively a lot closer to the company's likely core value.

"Most of these deals were done long before Marissa got to the company, and it certainly makes little sense to evaluate her performance based on deals that were closed years before she came," said a spokesman for the company. "It's not the same set of people who did these deals."

Yahoo has faced a different set of challenges than a newer company like Alphabet, which has seen its value grow at a rate that far outweighs the 190 acquisitions it has made since its 2004 initial public offering. Microsoft, which has been around a lot longer, has purchased about $60 billion in other companies and has a market value of $409 billion. Here's how Yahoo's total acquisition transactions stack up as a percentage of total market value (including the value of its Alibaba stake):