U.S. crude prices closed higher after a choppy trading session on Wednesday as data showing record U.S. crude stocks was offset by evidence that production in an oversupplied market continues to decline.

The Energy Information Administration reported crude inventories rose by 10.4 million barrels to a total of 518 million barrels. The build was almost three times more than the 3.6 million-barrel increase expected by analysts.

The American Petroleum Institute (API) said on Tuesday U.S. crude inventories jumped by 9.9 million barrels last week, much more than the 3.6-million-barrel increase analysts had forecast.

But the drop in production to levels not seen since late 2014 gave bulls hope, Dow Jones reported.

EIA reported U.S. oil production fell last week by about 25,000 barrels per day (bpd) to just over 9 million bpd, down from a peak of 9.6 million bpd in April. More reliable monthly figures from EIA put U.S. crude production at 9.2 million bpd in December.

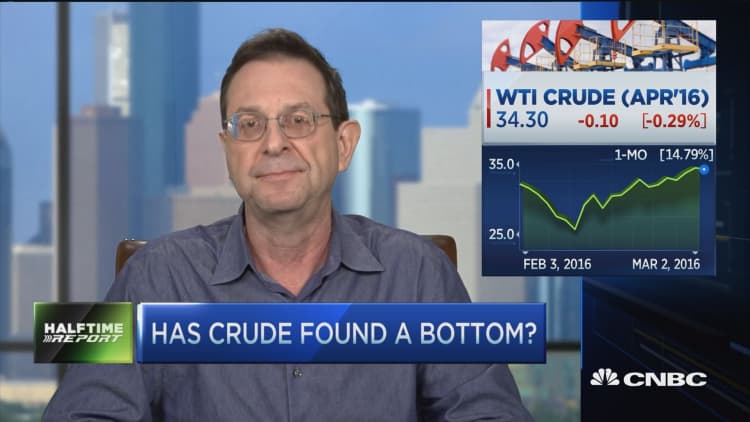

U.S. crude, also known as WTI, settled at $34.66 a barrel, up 26 cents, or 0.76 percent, after hitting a session peak of $35.17, its highest level since early January. WTI also posted its best settlement since Jan. 5.

Global benchmark Brent crude gained 13 cents to $36.94 a barrel, having earlier spiked to $37.40, the highest in almost two months.

Brent has risen 35 percent from a 12-year low of $27.10 hit on Jan. 20, adding to expectations that further drops may not be on the cards. An analyst at the International Energy Agency said on Tuesday prices appeared to have bottomed.

"Today's EIA data will do very little to help oil's recent bounce," said Chris Jarvis, analyst at Caprock Risk Management in Frederick, Maryland. "In short, it's difficult to make a bullish case. Signs that the glut in oil and reversal of the building trend will subside any time soon seems distant."

Crude has collapsed from more than $100 in mid-2014, pressured by excess supply and a decision by the Organization of the Petroleum Exporting Countries to abandon its traditional role of cutting production by itself to boost prices.

After more than a year of failing to agree any steps, OPEC and outside producers have stepped up diplomatic activity to fix the supply glut. Saudi Arabia, Qatar, Venezuela and non-OPEC producer Russia said on Feb. 16 they would freeze output.

On Wednesday, Venezuela's Oil Minister Eulogio Del Pino said more than 15 countries will attend an upcoming oil meeting to discuss an output freeze plan and possible further actions, state oil company PDVSA said in a statement.

In an early sign that Moscow will stick to the plan, Russia reported on Wednesday its oil output was little changed in February.

Russia's Rosneft, the world's biggest listed oil producer by volume, is floating the idea of a domestic production cut to balance the global market and as the firm faces a natural decline this year, two industry sources said.

Saudi Arabia has yet to report its production, but a Reuters survey this week found no sign of an increase in February.

"Although the market had hoped that some of these producers would immediately cut oil production, we still see this agreement as a strong message," ABN Amro said in a report.

"By announcing a production freeze, the global oil coalition has set a floor under oil prices."