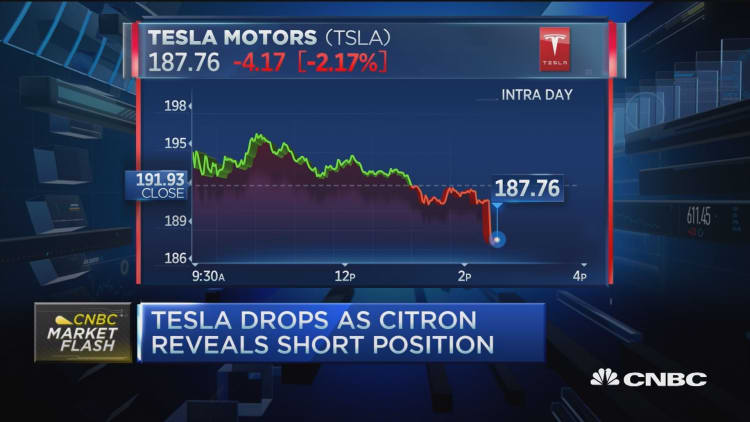

Tesla Motors shares slid Tuesday as Citron Research revealed a short position in the electric automaker's stock.

In a tweet, the short-selling firm contended that Tesla shares could fall to roughly half their current value by the end of the year due to supply and demand problems. The "news flow all around does not look good" for Tesla, Citron wrote.

The company's shares fell more than 4 percent at their lows Tuesday, but pared those losses. Tesla did not immediately respond to a request for comment.

Growth and production concerns swirl around Tesla as the automaker launches its Model X and Model 3 vehicles. Citron — a foe of embattled drugmaker Valeant Pharmaceuticals — said Tesla's stock could fall to $100 per share from above $180 currently.

Still, Tesla's outlook last month buoyed investor hopes. The automaker said it expects to deliver 80,000 to 90,000 new vehicles in 2016, versus previous Wall Street expectations for 79,000 deliveries, according to StreetAccount.

For the fourth quarter of 2015, Tesla's global deliveries rose about 76 percent year over year. Its sales in the period spiked 59 percent.

Tesla said in the earnings report last month that the rollout of its Model 3 sedan would send operating expenses about 20 percent higher in 2016. Still, on its earnings call, Chief Financial Officer Jason Wheeler said the company looked to boost margins with a "relentless focus on automotive unit cost reductions."