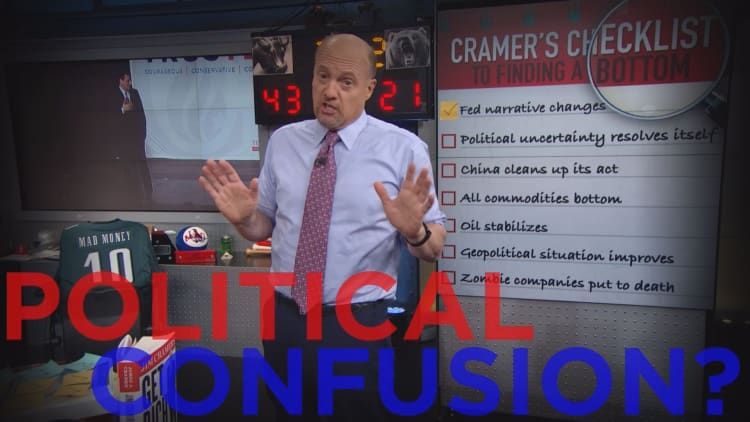

The stock market certainly feels better to Jim Cramer, but the question still remained if it is actually better. To determine the progress, he turned to the market-bottom checklist created back in January to determine if this market really has what it takes to provide a sustainable rally.

No. 1 The Fed must provide clarity on where it stands for rate hikes. Based on the recent commentary from James Bullard and Bill Dudley, Cramer will check this one off, as long as there isn't a strong employment number Friday.

No. 2 Political uncertainty must be resolved. Barring something extreme, Hillary Clinton and Donald Trump appear to be the leaders. That means investors can now resume preparing their portfolios for either eventuality, which means a this box is checked.

No. 3 China must get better. It's actually gotten worse, but the Baltic freight index as gone higher and there is a big meeting in China this weekend with an expected stimulus. This one is a half-check.

No. 4 Commodities must bottom. With copper leading the rally in commodities, Cramer is feeling more confident. Check.

No. 5 Oil must stop going down. Oil stocks have stabilized and even with a large increase in inventory on Wednesday, oil still went higher. Check.

Though the list continued down to No. 14, Cramer felt confident with the progress made in the past few weeks.

"You are never going to have all the planets align at once. But there are enough checks and half-checks for me to say that it makes sense to buy the dips in this market," Cramer said.

As for the rips, Cramer recommended not to sell them because they could be real.

Honeywell International on Tuesday dropped its merger bid for United Technologies. Now Honeywell CEO David Cote says his firm will walk away without going hostile.

"I can say that at $108, this is already an incredible deal, or, I should say, was an incredible deal," Cote told Cramer on Wednesday. "... There was a lot of value there already, but if they don't want to do it they don't want to do it."

Cote also said that, had the deal been successful, he would have considered serving as CEO of the combined company.

"It seemed to me that just reputation wise, investors would feel more comfortable if I was doing that," he said. "And I said I would be willing to do that, even though I'm 63 and a half."

United Technologies did not immediately return a call for comment.

If there is one thing that Cramer understands about retailers and restaurants these days, it is that consumers want value. This was evident in the rise of DineEquity, the parent of Applebee's and IHOP, with more than 3,600 locations spanning 20 different countries.

DineEquity reported one week ago, and delivered a strong 27-cent earnings beat from a $1.32 basis on higher than expected revenue.

Has the company finally gotten its groove back? Cramer spoke with DineEquity Chairman and CEO Julia Stewart to learn more.

"We have a huge amount of free cash flow that we will be generating this year, as we always have. …We have always said the large majority of that would either be returned to shareholders in the form of a dividend or share repurchase. This year doesn't appear to be any different," Stewart said.

Increasingly, Jim Cramer's point of view is that the Federal Reserve will hold off on raising interest rates in March. What could this mean for homebuilding stocks?

Tri Pointe Group is a family of regional homebuilders, with a stock that declined in December just after the Fed raised rates. The company reported last Friday and delivered a beat on earnings with higher than expected revenue, that rose 38 percent year-over-year.

Management provided bullish guidance for 2016, yet the stock barely budged. Cramer spoke with Tri Pointe CEO Doug Bauer to find out what investors can expect going forward.

"Earnings from the housing will grow in double digit fashion between '16 and '18, so my job is to keep executing. And that is our game plan," Bauer said.

In the Lightning Round, Cramer gave his take on a few caller-favorite stocks:

Palo Alto Networks: "The quarter was really good; the stock had a very big move. It is now consolidating, and I think it is ready to go higher."

Rite Aid: "Two ways to win here. Walgreens, which has a big position in the charitable trust, either they are going to close the deal and you will make money. Or if they walk away, I think there are other buyers. I like Rite Aid, but I do prefer Walgreens."