This is a breaking news story. Please check back for further updates.

Amid rising recession expectations and turbulent financial markets, companies kept on creating jobs in February.

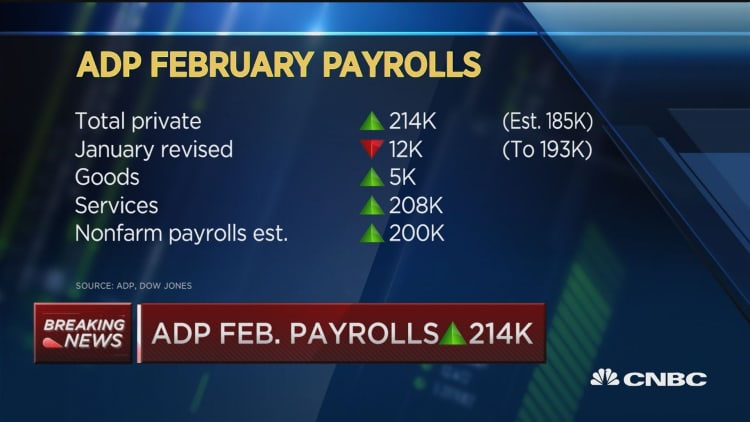

New hires totaled 214,000 for the month, according to a a report Wednesday from ADP and Moody's Analytics that could brighten the mood on Wall Street, which has been reeling from a series of weak economic reports. The figure easily topped economist expectations of 190,000.

Despite the better than expected number, the report highlighted concerns over the jobs picture. Almost all of the new positions — 208,000 in total — came from the services sector. Manufacturing, a sector that has been in contraction for several months, lost 9.000 positions, while financial activities, a bright spot in the January report with 19,000 new jobs, added just 8,000 in February, the lowest level since August.

January's total count was revised lower, from 205,000 to 193,000.

Firms with more than 500 employees, which have lagged during the recovery, added 76,000 positions in February, tied with small business, or those with fewer than 50 workers. Companies with more than 1,000 workers were particularly strong, adding 62,000.

Professional business services led the way among sectors, adding 59,000, a big gain from January's downwardly revised 38,000, while trade, transportation and utilities contributed 20,000, which was off the 26,000 in January, a number that also was revised lower. There were 27,000 new construction jobs, which was a slight increase from the previous month.

The numbers come two days ahead of Friday's key nonfarm payrolls report. Economists surveyed by FactSet expect to see 195,000 new jobs, up from January's 151,000, with the unemployment rate likely to hold steady at 4.9 percent.

The ADP report occasionally will lead Wall Street experts to adjust their expectations, though there often is a substantial difference between the two reports.

"At the current rate of job growth — 250K plus per month — we are absorbing any remaining slack in the labor market very rapidly," Mark Zandi, chief economist at Moody's Analytics, told CNBC. "We're closing in on full employment."

Despite the fairly consistent pace of job gains, economists have been ratcheting down estimates for first-quarter growth on the heels of the 1 percent GDP gain in the fourth quarter. The Atlanta Fed's GDPNow tracker has been aggressively marking down its projections, with the latest estimate at 1.9 percent after being as high as 2.7 percent just a few weeks ago.

The jobs figures are central to the Fed's thinking. The Federal Open Market Committee meets next week, though few on Wall Street are expecting the panel to hike its interest rate target.