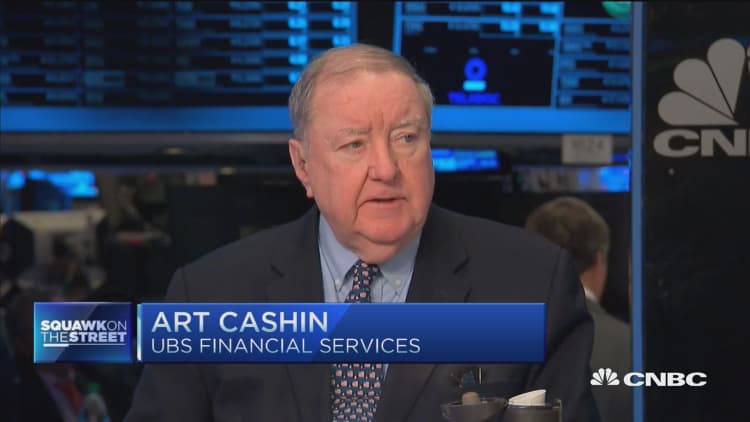

Investors need to be careful when looking at the February U.S. jobs report, Art Cashin, UBS' director of floor operations at the NYSE, said Thursday.

"We've had some distortions in previous numbers. We had a number, I think two months ago, that made it look like there were 200,000 payroll jobs, and when you took it apart, a lot of that was added seasonal adjustment," Cashin told CNBC's "Squawk on the Street." "I think this number may also be distorted. Back then, it turned out there were only 10,000 real jobs, not 200,000."

The report is due Friday morning and economists polled by Reuters expect jobs in the U.S. to have increased by 190,000. The January report showed an expansion of 151,000.

Stocks were lower midmorning Thursday, but have been trending higher since Feb. 11, when the hit its 2016 intraday low.

The fall in equities — coupled with plunging commodity prices and a slowdown in the Chinese economy — have given way to a rise in global recession fears. David Kelly, JPMorgan Funds chief global strategist, said Thursday he thinks these fears are overblown.

"We never were close to a recession, but it is still relatively slow growth. The global manufacturing PMI numbers that have come out in the last few days are pretty slow, but within the U.S., we basically got an economy at about a 2 percent pace. The trick is that this is an economy that can only do about 1.5 percent in the long run," Kelly said in another "Squawk on the Street" interview.

"Two percent growth will be enough not only to give us something like 152,000 other jobs, but continue to put downward pressure on unemployment, [and] continue to put pressure on wages. We're still growing a bit faster than potential here, and I think that's a pretty good thing for stocks."

Also on "Squawk on the Street," Joshua Feinman, chief economist of Deutsche Asset Management, agreed with Kelly's assessment.

"I think the base case is the U.S. economy is doing more or less what it's been doing throughout this recovery, which is growing at a moderate pace," he said.