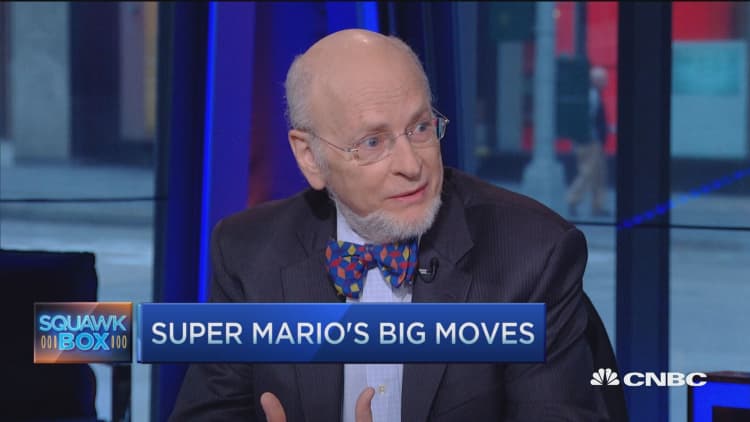

With the financial world continuing to hang on every word from global central banks, there's another lever that's being overlooked that could help spur economic growth, said David Blitzer, chairman of the S&P Dow Jones index committee.

"Virtually the entire world has abandoned fiscal policy, period. Sooner or later they're going to figure out that they left half the toolbox behind, and at least they ought to open it up and look into it," Blitzer, an economist at his core, told CNBC's "Squawk Box" on Friday, a day after the European Central Bank unveiled additional, aggressive stimulus moves. But ECB President Mario Draghi also said he did not anticipate a need for further interest rate cuts.

"[Investors] are clearly trying to figure out how long the ECB can keep it up. They lost the power of Draghi just saying, 'Yes, I going to do whatever it takes,' " Blitzer said.

John Ryding, chief economist and founding partner of RDQ Economics Chief, said on "Squawk Box" in the same interview that Thursday's easing measures by the ECB and recent easing by the Bank of Japan cut both ways. "When these central banks make these moves, at the time same, they tell us things are worse."

Meanwhile, the Federal Reserve is debating whether to increase interest rates again. Ryding said the Fed created a "catch-22" when it opted not to hike rates in September due to market turmoil and concerns about China's economy.

On one hand, those same considerations linger, Ryding said. But since the Fed keeps saying it's data dependent, policymakers should be increasing rates because recent economic reports have been pretty good, he said.

Neither Ryding nor Blitzer expect the Fed to hike rates at its March meeting next week.

When the central bank raised rates for the first time in more than nine years in December, policymakers predicted four more hikes in 2016. The financial turmoil at the start of the year had scaled back those expectations among traders. But recent strength in stocks and oil, which both set recent bottoms on Feb. 11, has been bringing back thoughts of a more aggressive path higher for rates.