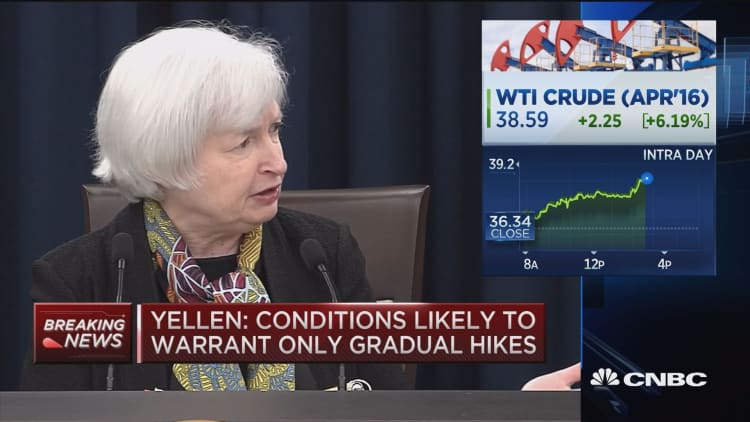

The Federal Reserve did not raise interest rates on Wednesday and was more dovish than strategists and economists expected.

In its statement, the U.S. central bank said "global and financial developments continue to pose risks." Bill Gross, who manages the Janus Global Unconstrained Bond Fund, told CNBC's "Power Lunch" after the announcement that the Fed had enough data to not raise rates. In particular, Gross pointed to negative data points like industrial production and weekly earnings.

"The U.S. economy is not doing that well," he concluded.

"In combination with the global condition that the statement spoke to and the domestic condition, yes, the dots are down by 50 basis points and beginning to reflect a more realistic condition in terms of what the Fed can do going forward," Gross said.

Michelle Meyer, deputy head of U.S. economics at Bank of America Merrill Lynch, told "Closing Bell" on Wednesday that this is a cautious Fed that is reacting to market moves and data points.

"What they're telling us is that you had significant stress in the beginning of the year in the markets. Financial conditions tightened. They want to see how that plays out in the real economy," Meyer said.

"They want more time to assess and as a result, they sounded a bit more dovish than we would've expected," she said.

Rick Rieder, chief investment officer of global fixed income at BlackRock, said the Fed is willing to let inflation rise higher than it's indicated.

"This is a Fed … that would rather see inflation run hotter and employment run hotter, because there's so many tools to break it, but you don't have many tools to bring it up, particularly if you're deflating. You can always rein it back in," Rieder said on "Closing Bell."

"Once you move rates down, the elasticity starts to slow," Rieder said. "I think markets are going to realize we've already hit the elasticity point where you get a real impact in the economy."

Bond guru Gross remained pessimistic on the Fed and said that central banks, including the Fed, have "been engaged in a series of monetary policies since 2009 that produced substandard economic growth and created financial asset bubbles of significant proportions."

"Central banks have been following a model that's historically aged and they need to come into the 21st century. They're still in the 20th century," Gross said.

Scott Minerd, global chief investment officer of Guggenheim Partners, agreed with Gross, adding that statements from central bankers need to be taken with a grain of salt.

"Remember, it was Ben Bernanke that told us that the subprime crisis was a contained crisis. It was Alan Greenspan who told us that there was no bubble in the stock market," Minerd said on "Power Lunch."

"Central bankers are notorious essentially for getting it wrong. I think it's because — being around them and exposed to them a lot — they get into a groupthink, academic kind of world," he said.

— CNBC's Anita Balakrishnan contributed to this report.

Correction: Rick Rieder is chief investment officer of global fixed income at BlackRock. An earlier version of this story misstated Rieder's updated title and misspelled his name in one reference.