Jim Cramer always says to know what you own and be ready for a buying opportunity.

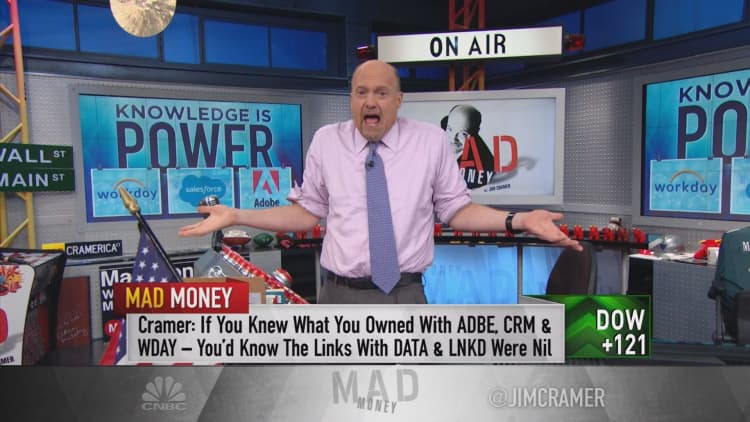

In the first week of February, "Mad Money" interviewed the CEOs of Adobe, Salesforce.com and Workday, all of whom had exciting innovation to share.

"If you listened to those interviews, even though the companies weren't able to reveal their actual numbers, you heard stories of accelerating revenues, rapid adoption of product, robust total addressable markets and war stories of conquest," Cramer said.

If you knew what you owned with these three companies … you would have understood that the similarities between Tableau Software and LinkedIn and those three companies were nil.Jim Cramer

Few CEOs were as bullish as Shantanu Narayen, CEO of Adobe, who talked about an acceleration of revenue from cloud subscription products designed to address marketing and creativity. It made Cramer think Adobe had the most momentum of them all.

Then Tableau Software and LinkedIn both reported hideous quarters and took down the stocks of all three companies.

Read more from Mad Money with Jim Cramer

Cramer Remix: This company is king

Cramer: Signs a massive rally could be coming

Cramer on the Fed: What changed since December?

"The decline was still breathtaking," Cramer said.

Meanwhile, Salesfore.com reported a few weeks ago and delivered a fantastic quarter. Workday's business accelerated and had a number of blue chip client wins.

And when Cramer saw Adobe's stunning quarter on Thursday, he knew that the damage these stocks incurred during the Tableu-LinkedIn fiasco was a rare opportunity.

"If you knew what you owned with these three companies … you would have understood that the similarities between Tableau Software and LinkedIn and those three companies were nil," Cramer said.

This was a chance for an amazing buying opportunity. So, as Adobe now shoots to its all-time high, Cramer reminded investors of the power of homework and power of price.

If those elements are remembered, you can catch the next fabulous buying opportunity, like the ones that occurred with Salesforce.com, Adobe and Workday.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com