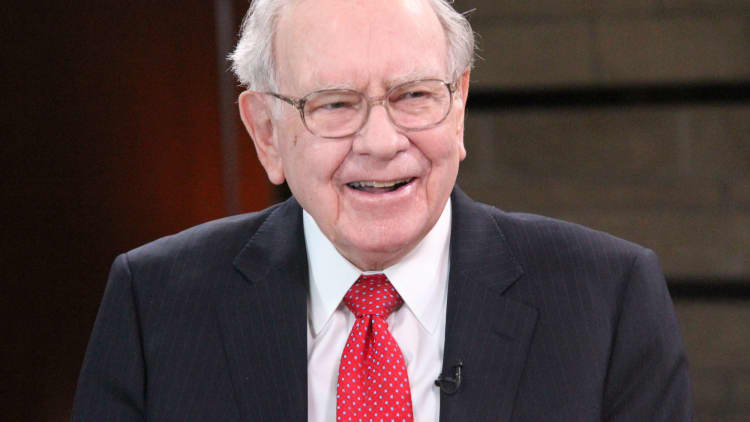

A UBS note on Monday said that Warren Buffett's Berkshire Hathaway is positioned to outperform in the current economic environment. But you have to have big money to take advantage of it.

The firm initiated coverage on the company's Class A shares with a buy rating and price target of $244,500 per share, indicating an upside of more than 16 percent from Friday's close at $210,530. UBS also sees limited downside risk since Berkshire plans to buy back shares at 1.2 times their book value.

In the last 12 months, the company's Class A shares are down 2.5 percent while the is only down 1.2 percent. UBS explains that the stock's underperformance in 2015 is mostly due to softness in insurance and railroads.

Looking ahead, the firm said that Berkshire has structural advantages that should allow it to "grow earnings and book value faster than the S&P 500."

UBS' analysis also found that Berkshire's Class A shares generally outperform during bear markets due to the company's "high quality investment characteristics and strong capital position." Berkshire has also outperformed the market during periods of high volatility, including after the Sept. 11 attacks and the most recent financial crisis.

UBS also said Berkshire's $1 billion of free cash flow per month gives it a flexible "war chest" that can be deployed for strategic acquisitions or to fund growth in its businesses. The company's conservative capital management and emphasis on maintaining liquidity makes it a strong investment choice in a flight to safety.

Berkshire's board has also approved a buyback of its Class A and Class B shares capped at a 20 percent premium of their book value. While this program has no expiration date, the stocks have not traded below 120 percent of book value since it was announced. UBS sees this repurchase program as a limit on the downside risk in the stock.

While some investors dread the day that the 85-year-old Buffett leaves the company, UBS believes that any "Buffett premium" has declined in importance as Berkshire continues to diversify its holdings.

The firm said that "while Buffett's superior capital allocation skills and market 'clout' would be missed, as long as the culture does not change, [it] would expect the company to continue to outperform."

In the short term, UBS does not believe much would change after Buffett leaves the company. Currently, the firm believes that the Oracle of Omaha "primarily adds value through capital allocation decisions and his standing in the capital markets as a go-to provider of quick capital."