In the topsy-turvy world of investing it appears that bad might just mean good.

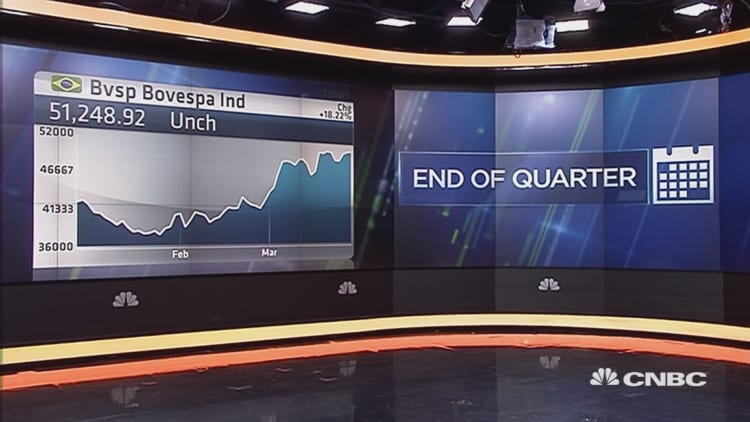

Despite an economic and political crisis, the stock exchange of Brazil has managed to clock the largest percentage gain so far this year amid major volatility for other global indexes. The main stock index, the Bovespa, is set to finish the first quarter on Thursday with a rise of around 20 percent in U.S. dollar terms.

The country's Companhia Siderurgica Nacional (CSN), primarily engaged in the steel industry, has led those gains with a rise of 85 percent year-to-date after piggybacking on the rebound in metal prices.

But that doesn't truly tell the story of Brazil's economy.

Brazil was recently handed a two-notch downgrade by U.S. ratings agency Moody's, the third agency to strip the country of its investment grade rating. The International Monetary Fund forecasts Brazil's economy will shrink by 3.5 percent this year, following a 3.8 percent contraction in 2015.

Mass protests are taking place in city streets with citizens angry at a deepening political crisis. President Dilma Rousseff is under scrutiny as part of an investigation — known as Operation Car Wash or Operacao Lava Jato — into the massive corruption scandal at Brazil's state-run oil company, Petrobras. Rousseff's largest coalition partner split from her administration this week which has made her impeachment all the more likely.

"The rally has been driven by political turmoil as investors view the recent impeachment proceedings against president Dilma Rousseff as a step in the right direction as it could lead to an ousting," Simon Colvin, a research analyst at data firm Markit, said in a note on Thursday.

"Rousseff has so far been unwilling to make the cuts required to address Brazil's fiscal woes."

Meanwhile, a dovish U.S. Federal Reserve, which appears to be shying away from the monetary tightening it had planned for 2016, is bringing emerging markets back into focus.

At the close on Tuesday, the iShares MSCI Emerging Markets ETF (exchange-traded fund) was on track for its best month since October 2011, with a rise of 13.75 percent. On the quarter, it's up 7.2 percent and on track for its best quarter since the fourth period of 2012.

Turkey's BIST 30 index isn't far behind Brazil with a year-to-date rally of around 17 percent. This despite the migrant issues the country is facing, the terrorist attacks it has experienced and the criticism its leadership has faced from Western powers.

"Everyone has been short Turkey for some time," Timothy Ash, head of emerging markets research at Standard Bank, told CNBC via email.

Easy global financing conditions and supportive technicals are some of the reasons behind the move, according to Ash. He also notes that Turkey has a "cheap" currency, an improving current account deficit, strong public finances and favorable demographics.

—CNBC's Katy Barnato contributed to this article.