Investors shorting Tesla Motors' stock could wind up on the wrong side of the trade, CNBC's Jim Cramer said Tuesday.

"The shorts want Tesla down. So when Tesla says it can make 1,180 fewer cars than the company expected, suddenly the shorts come in. My advice is be very careful if you're shorting this stock because, in the end, this is one of those animal-spirited stocks that's really based on the deposits and the interest in the cheaper car," Cramer said on "Squawk on the Street." He was referring to the Model 3, which was unveiled last week and has a $35,000 starting price. Production begins in 2017.

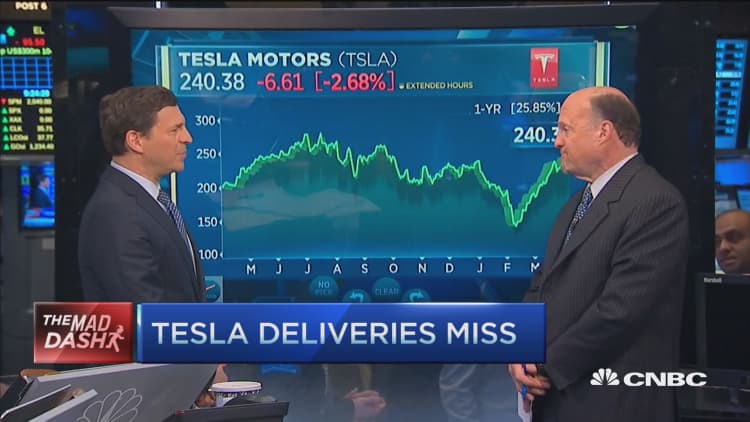

The Elon Musk-run company said Monday its first-quarter auto deliveries were slightly lower than expected, pushing the stock down slightly Tuesday after it got a boost from better-than-expected preorders for the Model 3,

"All I can tell you is Mr. Musk is Mr. Rabbit Out of a Hat and yes, the stock is impossible to value. Amazon was impossible to value; Tesla is impossible," Cramer said. "It's a conundrum; it's an enigma. … It's full of sound and fury signifying nothing. But it doesn't matter."

"The buyers want the car, and they want to buy the stock."

Shares of Tesla are up just 2.5 percent for the year, but have gained over 7 percent in the last week.

Disclosure: Cramer's trust did not own Tesla or Amazon stock when this article was published.