The world's largest oil company will soon become the world's largest public investment fund.

That's big news, but what exactly does it mean?

Saudi Prince Mohammed bin Salman said earlier this month that his country would transfer ownership of the Arabian American Oil Company and some other national assets to the Public Investment Fund, one of several sovereign wealth funds through which the country invests excess cash from its oil and gas operations.

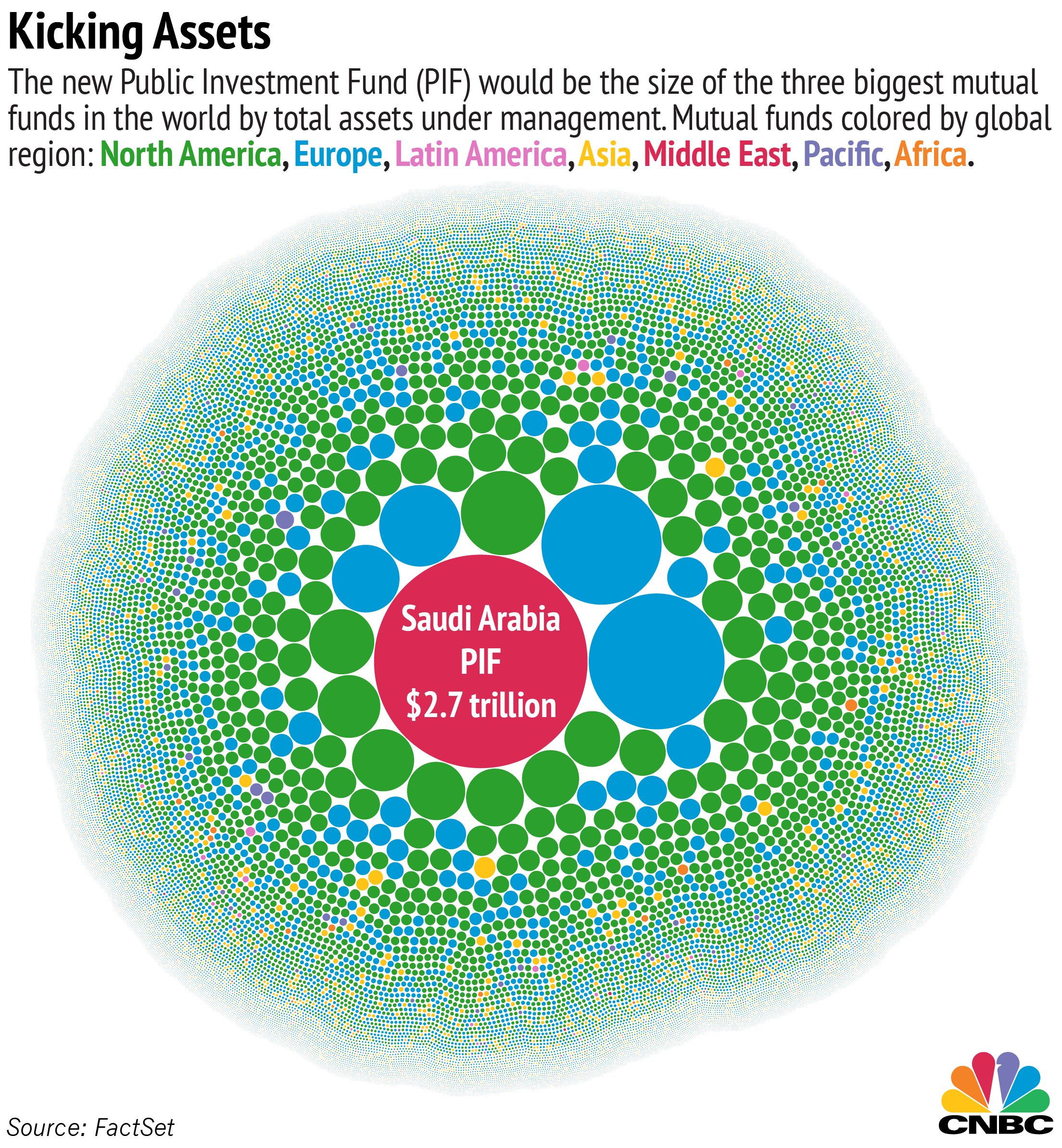

Initially, only about 5 percent of Aramco will be listed on the Saudi stock market. But if investors are willing to pay $10 for each barrel of reserves left in the country, Aramco as a whole should be worth about $2.7 trillion.

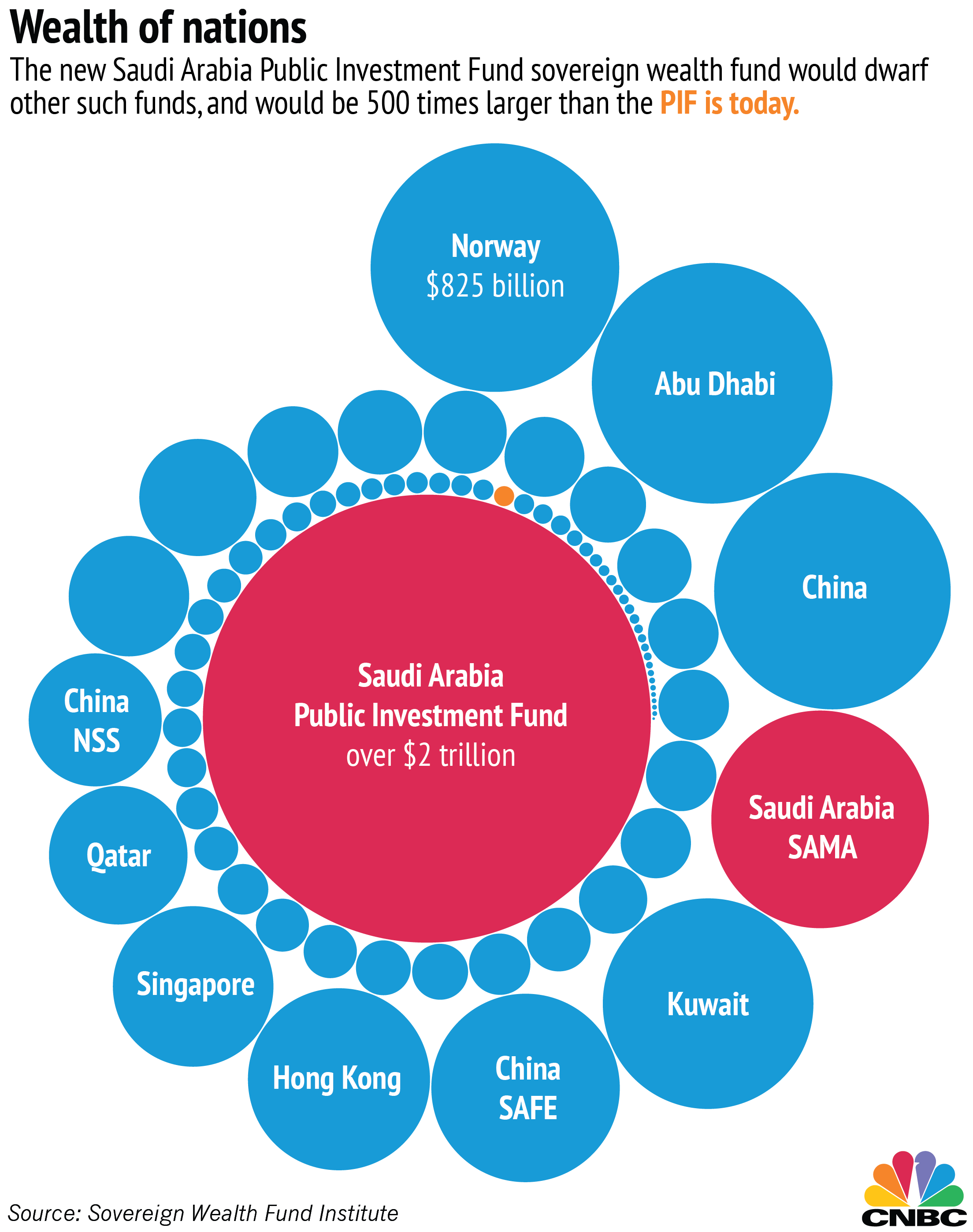

Simply by transferring Aramco equity to the PIF, the fund will become the biggest on Earth. Here's how the newly endowed fund would stack up compared with the other sovereign wealth funds, as tracked by the Sovereign Wealth Fund Institute.