The world's second-largest economy expanded 6.7 percent on-year in the first quarter, slightly slower than the previous quarter's 6.8 percent pace, according to official data released on Friday.

The results were bang in line with market expectations and suggested that the government's target range of 6.5 to 7 percent growth for 2016 was feasible as long as officials continued to use their vast policy toolbox to stimulate the economy.

For 2015, Beijing logged 6.9 percent growth, its slowest pace in 25 years.

Market reaction was modest, with the benchmark Shanghai Composite and the Hang Seng Index losing 0.3 to 0.4 percent each. The Australian dollar, a proxy for Chinese sentiment, ticked up 0.2 percent while the yuan was little changed around 6.4868 per dollar.

Other data out on Friday included fixed asset investments (FAI), industrial production and retail sales.

First quarter FAI climbed 10.7 percent on-year, a touch above the 10.3 percent rise Reuters predicted. For March, retail sales surged an annual 10.5 percent, versus estimates for a 10.4 percent increase, and industrial output rose 6.8 percent on-year, better than Reuters' 5.9 percent forecast.

The stimulus effect

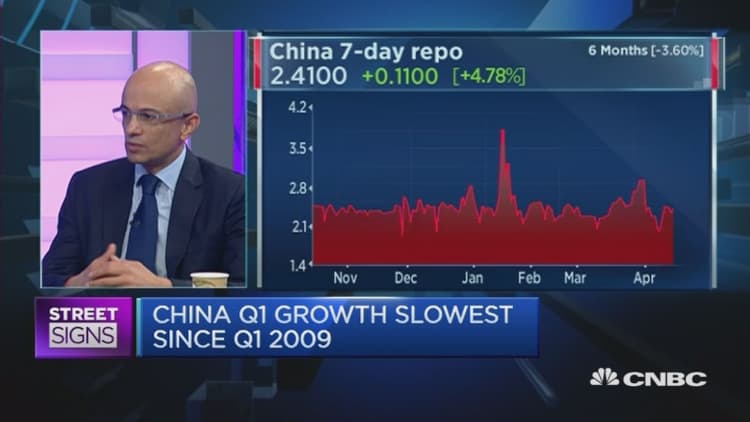

Friday's growth report revealed China's aggressive monetary stimulus was finally bearing fruit, Jing Ulrich, managing director and vice chairman for Asia Pacific at JPMorgan Chase, told CNBC's "Street Signs."

The People's Bank of China (PBOC) has lowered interest rates six times since November 2014 as well as slashing the reserve requirement ratio (RRR) for banks. The central bank's last action was in February, when it reduced the RRR by 50 basis points.

"Data from the investment-industry nexus show that the tried-and-tested stimulus measures of recent months have stirred up the physical part of the economy, especially towards the end of Q1, while consumption remained relatively robust," Louis Kuijs, head of Asia economics at Oxford Economics, echoed in a note.

Continued support could help Beijing hit 2016 GDP growth of 6.5 percent, within the government's range, Kuijs added.

But Ulrich did not expect the PBOC to unleash aggressive stimulus anytime soon because the economy currently had upside momentum. Policy would remain accomodative but the PBOC would for more data before unleashing any immediate rate cuts, she said.

Mixed sentiment

China's shrinking economy has long been a focus for global markets, as President Xi Jinping engineers a structural slowdown to re-orient the country way from manufacturing towards domestic consumption and services. In recent months, motley batches of data have soured sentiment but following a rough start to the year, a host of key economic indicators are now pointing upwards.

In March, exports logged a sharp recovery, foreign exchange reserves posted their first monthly increase since November and the official manufacturing Purchasing Managers' Index (PMI), which tracks factory activity at large companies, returned to growth for the first time since July 2015.

Moreover, concerns about the yuan seem to have largely dissipated. It fluctuated earlier this year as Beijing switched to pegging the currency to a basket of its trading partners' currencies instead of the dollar, but has since stabilized.

"The economy has shown signs of stabilization in recent weeks and that's helped global markets, risk appetite has improved and currencies look stable, at least temporarily," said Mitul Kotecha, head of Asia FX and rates strategy at Barclays.

But others warn against undue optimism.

"The new economic data may be knocking the wind out of the argument that the Chinese economy is heading for a hard landing, but I believe it's premature to think that the economy is bottoming out. It's far too early to start talking about a V-shaped recovery. Sure, there are plenty of bright spots but there are some genuine areas of concern," said Kamel Mellahi, professor of strategic management at Warwick Business School, referring to structural reforms.

Dealing with the growing pile of corporate debt, estimated at around 160 percent of GDP, and reducing overcapacity at state-owned enterprises(SOEs) to boost productivity are two of the biggest reforms on Beijing's to-do list.

In a report this week, the International Monetary Fund (IMF) warned that about $1.3 trillion of corporate bank loans were owed by firms who did not earn enough to make interest payments. If left unchecked, that could result in bank losses equal to 7 percent of GDP, the IMF said.

The most at-risk sectors included real estate, manufacturing, retail, mining, and steel, where earnings relative to interest expense have fallen despite declining nominal interest rates, according to the IMF report.

Now that the economy has finally stabilized, this is an opportune time for Beijing to push ahead with these reforms, said JPMorgan Chase's Ulrich.