The Bank of Japan became the latest central bank to throw markets a curveball — suggesting one move and in this case, delivering no move at all.

Expectations had been building for weeks ahead of Thursday's policy meeting that the BOJ was ready to deliver a major new easing program, including expanding the negative yields to bank loans or more purchases of equity ETFs. BOJ Governor Haruhiko Kuroda suggested in multiple conversations at international media events that he has additional options available to turn around the Japanese economy. While a few firms notably expected no action, many BOJ watchers around the world took his comments to mean another round of stimulus was coming.

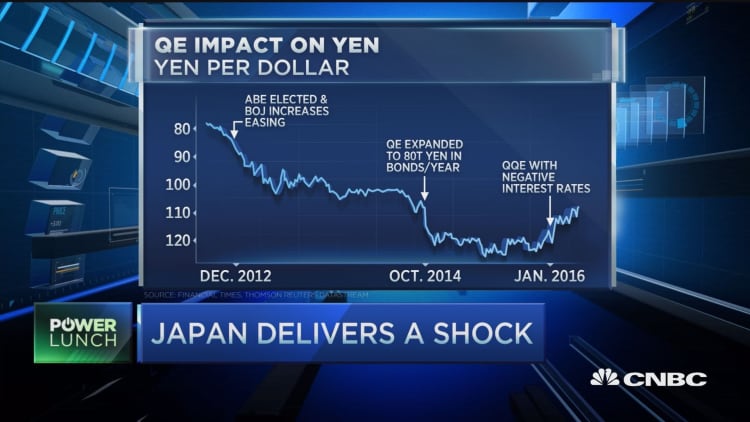

Yet in Thursday's meeting — no action. That surprised the markets just as Kuroda's surprise move to negative yields did back in January, and the market reaction has been violent. The Nikkei lost 3 percent Thursday, and the yen rallied hard amid an immediate sell-off in global risk assets. The lack of action now raises new questions of whether Japan really is running out of options, or whether the BOJ is buying time, adjusting to its last policy shocker, while it awaits a government stimulus plan.

"Japan has effectively surpassed China in confusing the markets more," said David Zervos, chief market strategist at Jefferies.

Marc Ostwald, emerging market strategist at ADM Investor Services, agreed, saying that Thursday's market reaction is the result of what he called "appalling" communication by the BOJ.

"The policy 'crime' that the BOJ committed was to indulge in endless off-the-record briefing of the local media about potential measures in recent weeks. If they had not done that, I do not think markets would have been expecting anything at today's meeting," said Ostwald.

Disconnect between what markets are expecting and what central bankers actually deliver continues to be a frustrating concern among traders. Earlier this year, China's central bank, the People's Bank of China, was highly scrutinized for sending mixed messages on the path of its currency, the yuan.

"The Japanese have once again chosen a path of economic suicide," Zervos told CNBC. The state of Japan's economy has been worsening as the world's third-largest economy grapples with deflation, slowing growth, deteriorating consumer confidence and an accumulation of high debt. The recent bullish swing in the yen complicates matters as Japan's economy is heavily reliant on exports.

Strategists say BOJ will likely be under intense pressure to calm markets in the coming weeks, especially if the yen continues its upward climb and Japanese stocks extend their sell-off. The Japanese Nikkei is down 12.4 percent so far this year.

"The BOJ's decision to keep policy on hold despite weak inflation data and a softening economy feeds worries that the BOJ does not have much firepower left and intensifies broader concerns that Abenomics has lost its way," said Charles Collyns, chief economist at the Institute of International Finance, to CNBC.

The Japanese yen surged 3 percent higher against the U.S. dollar, flirting with a 17-month high Thursday.

"We are all trying to cover our shorts on the yen," said the chief investment officer of a $4 billion fund in Singapore, who asked not to be named. One of the popular trades ahead of today's Bank of Japan meeting was shorting the yen on expectations that the BOJ would ease further given the recent weakness in economic data from the world's third-largest economy.

A large number of Japan watchers were anticipating some type of move by the BOJ: ETF purchases, extending negative rates to bank loans and/or introducing helicopter money were some of the ideas floated.

Strategists say bold action will be needed this summer. Brown Brothers Harriman says Kuroda could ease measures in July and is perhaps waiting for Abe's new fiscal package and the G-7 meeting to take place next month.

"BOJ wants to show that it still has the surprise factor on its side like a classic central bank," said Simon Quijano-Evans, chief emerging market strategist at Commerzbank to CNBC.

Several economists say Japan is still trying to digest the market's response to its introduction of negative rates, when the Japanese yen strengthened — the exact opposite of what the central bank was hoping for. "[Kuroda seems] uncomfortable with the backlash against negative rates, inefficacy of all previous easing," said Ostwald.

Other market strategists say Kuroda may be waiting for the Fed to act, which will effectively push the dollar up and the yen down.