Uber hasn't officially responded to the news that Apple has invested $1 billion in its Chinese rival, but a jokey tweet by the U.S. taxi app's boss about his girlfriend shows he is at least ready to make light of the situation.

Travis Kalanick, the chief executive of Uber, explained that his girlfriend owns Apple shares, which makes her an investor in Didi Chuxing, Uber's rival in China, which Apple took a stake in on Friday. Kalanick used #smh, which stands for "shaking my head."

The investment will most likely not be welcome news for Uber, which has been struggling in China. In February, the ride-hailing app said it's losing more than $1 billion a year in the world's second-largest economy. Didi claims to have an 87 percent market share and is backed by some of China's biggest internet giants including Alibaba and Tencent. The company is reportedly valued at $25 billion, below Uber's $62 billion valuation.

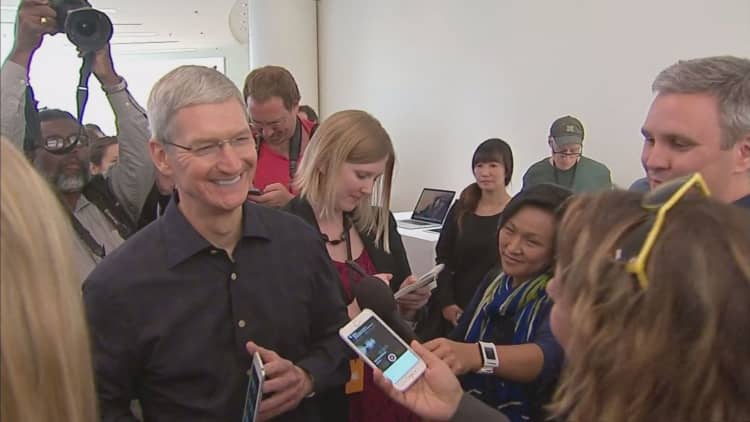

There are a number of reasons behind Apple's investment. In a press release, chief executive Tim Cook said it would give the Cupertino, CA–based technology giant the chance to gain local knowledge.

"We are making the investment for a number of strategic reasons, including a chance to learn more about certain segments of the China market," Cook said.

"Of course, we believe it will deliver a strong return for our invested capital over time as well."

Several reports over the last few months have also suggested that Apple is looking to develop an electric car, so investing in a company with links to the automotive industry seems sensible.

BGC Financial analyst Colin Gillis looked favorably on the tech giant's investment, telling CNBC's "Closing Bell" that this is better use of the company's $209 billion overseas that is "just sitting there, stagnant."

"Take that cash and deploy it," Gillis said. "Find those future growth opportunities."

Gillis saw this move as a potential "seed" that could spur future growth.

"Plant more seeds and you may get some multiple appreciation. There's no reason it shouldn't trade at least with the broader market," he said.