Fed phobia is running high ahead of Wednesday's release of Fed minutes.

The minutes, which will be released at 2 p.m. EDT, were already stirring up the bond market Tuesday morning, and that spilled into the stock market during the trading day.

"They are terrified of [the minutes], because there's a chance you'll get a sense of the bulk of the committee's views," said Art Cashin, director of floor operations at UBS. "Either way, it will have far more power than any number of individual speakers."

Read MoreThe market got too complacent on rate hikes: BlackRock

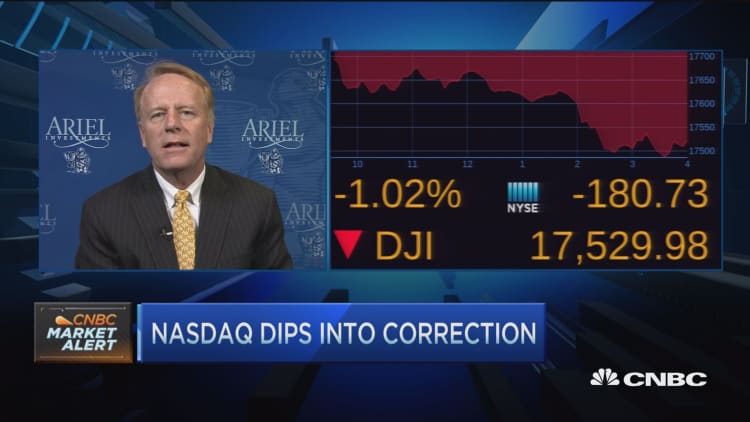

Stocks were pounded, with the off 0.9 percent to 2047. Treasury yields were higher across the curve, although the 10-year was barely moved at 1.75 percent. The Fed-sensitive rose to 0.82 percent, from a low of 0.78 percent. The 30-year bond yield actually moved lower to 2.57 percent.

"I think they're backing off in the front end (of the Treasury market) because they're worried about the minutes being a little bit hawkish," said John Briggs, head of strategy at RBS. "The data was a little bit firmer. It wasn't crazy, but we're continuing a string since Friday with better retail sales. Housing was better, core CPI was in line, industrial production was better. Is it a blowout? No. But it's contributing to the move."

The minutes are from the April 26 and 27 meeting where the Federal Open Market Committee held rates steady and stuck to its message that it would be slow to raise rates. The FOMC once more put the emphasis on the economic data, while leaving the door open to rate hikes without stating a time frame.

Two Fed speakers also added to the speculation Tuesday afternoon. Atlanta Fed President Dennis Lockhart and San Francisco Fed President John Williams were quoted as saying the Fed's June meeting is "live," meaning the Fed could raise rates during it. The market's expectations are that the Fed will not raise rates until the very end of this year or beginning of next year.

Lockhart also said the Fed could do two to three rate hikes this year, and that inflation and prices are moving in the right direction for the Fed. Lockhart is seen as one of the more dovish of the Fed presidents. Lockhart also said the Fed would consider any volatility around Brexit — the U.K.'s vote on whether to stay in the European Union. That vote is June 23, several days after the Fed meeting, and that is one reason some Fed watchers expect the Fed to hold off on a rate hike until July or later.

"The market's expectation for no rate increase this year is misplaced, given how strong the economy is, given how wage growth is picking up and inflation appears to be firming. Two, maybe three rate increases makes more sense. I think that's the realization the markets are coming to," said Mark Zandi, chief economist at Moody's Analytics.

Just last week, markets were obsessing over how a weaker-than-expected jobless claims report must mean something's wrong with the labor market, especially after April's weak nonfarm payrolls.

"It's [the data] going from a mixed bag to not such a mixed bag," said Steve Massocca of Wedbush Securities. "Looking at these numbers broadly, I don't see that huge a difference in economic activity than a few months ago. For some reason, everyone's got a bee in their bonnet about it today."

Massocca said stock traders got more concerned Tuesday when the two-year yield was moving higher. "It kind of came out of nowhere. Normally water would be rolling off everybody's back. The move that was going on in the two-year really accelerated. Then people started to think about it," he said of the Fed talk. "In terms of the two-year, we're going back to where we were two weeks ago."

Zandi said the key to the Fed's thinking could be in how they describe the financial market conditions that were tumultuous early in the year.

Read MoreGood news for stocks: No one expects good news for stocks

"You've got other voices that are more on the fringe, and they don't get the same play, so maybe they come out a bit in the minutes. That's a possibility. Maybe it shows there was more debate around the impact of the financial market turmoil at the start of the year, and maybe it will come through that they didn't see any fallout," he said. "If that were the case, it would be hawkish. It would suggest they're gearing up for the next rate hike."

In its post-meeting statement in April, the Fed did drop its concerns about international risks and said instead it was monitoring global developments

There are no economic reports Wednesday, but there are some earnings. Target, Lowe's, SABMiller, Tencent, Hormel Foods, Staples, Booz Allen Hamilton and Burberry report ahead of the opening bell. Cisco, Take-Two Interactive, L Brands, Salesforce.com, Urban Outfitters and Flowers Foods report after the close.